Nevada sales representative employment contract template

View and compare the Free version and the Pro version.

Help Center

Need to learn how to convert downloaded contract DOCX files to PDF or add electronic signatures? Please visit our Help Center for detailed guidance.

How Nevada sales representative employment contract Differ from Other States

-

Nevada law (NRS 608.150) mandates specific timelines for commission payments upon contract termination, differing from many states.

-

Nevada offers explicit statutory causes of action for sales representatives seeking unpaid commissions, providing additional legal remedies.

-

Non-compete agreements in Nevada must meet strict statutory criteria, which are more clearly defined compared to many other states.

Frequently Asked Questions (FAQ)

-

Q: Are commission payments protected by Nevada law?

A: Yes, Nevada law requires prompt payment of all earned commissions and provides legal recourse for unpaid amounts.

-

Q: Is a written contract mandatory for Nevada sales representatives?

A: While not mandatory, a written contract is strongly recommended to protect both parties and clarify all terms.

-

Q: Can non-compete clauses be enforced in Nevada sales rep contracts?

A: Yes, but only if they are reasonable in scope, duration, and geographic limitation, and comply with Nevada statutes.

HTML Code Preview

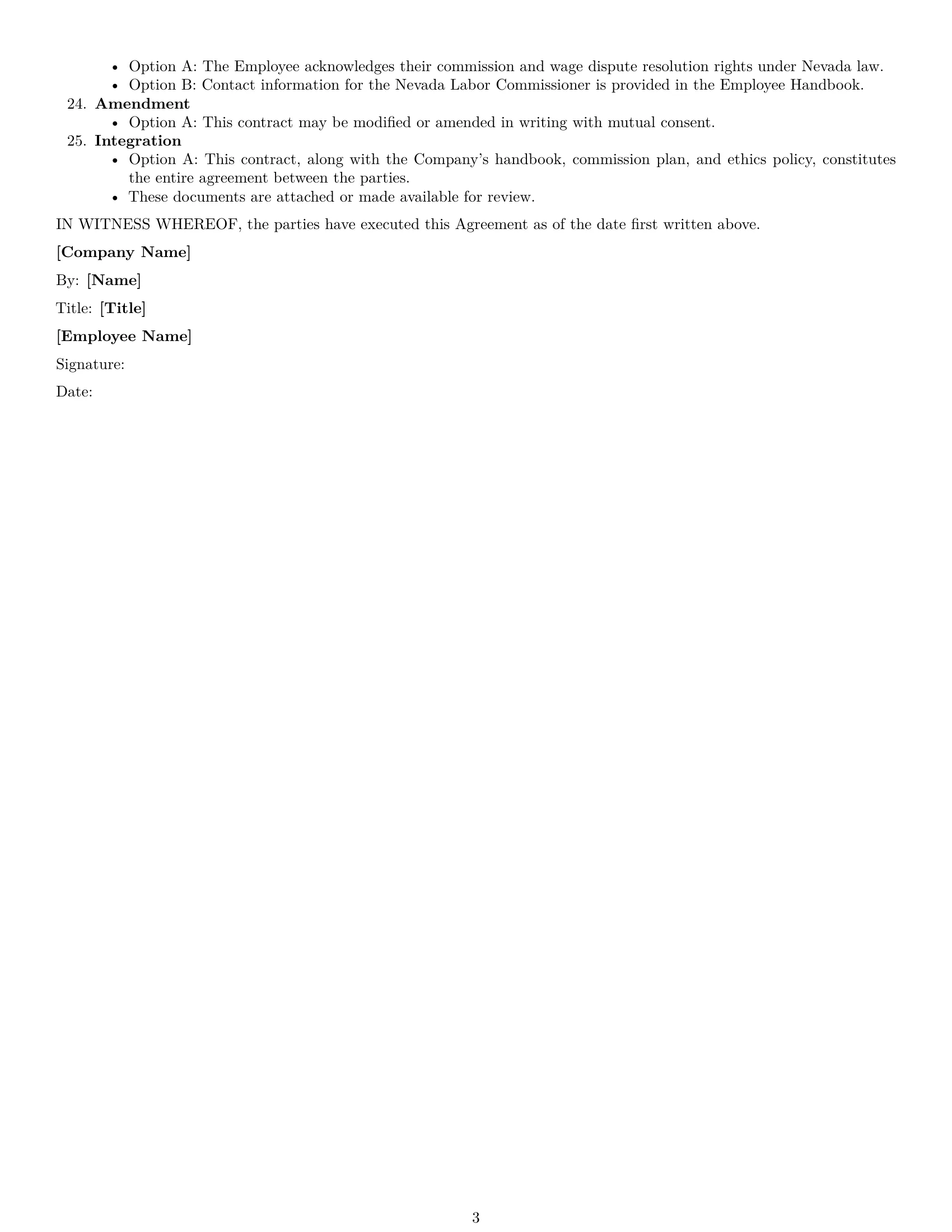

Nevada Sales Representative Employment Contract

This Nevada Sales Representative Employment Contract (the "Agreement") is made and entered into as of [Date], by and between [Company Name], a [State of Incorporation] corporation with its principal place of business at [Company Address] ("Company"), and [Employee Name], residing at [Employee Address] ("Employee").

Position

Option A: Sales Representative

Option B: Senior Sales Representative

Option C: Account Executive

The Employee is hired as a Sales Representative. Essential job functions include, but are not limited to: prospecting, lead qualification, client meetings, pipeline management, CRM system use, sales presentations, proposal preparation, contract negotiation, deal closing, post-sale client support, and achievement of sales targets.

Products/Services and Territory

Option A: The Employee will sell the Company's [Products/Services].

Option B: The Employee will focus on the [Specific Industry/Market Segment].

The Employee's territory will be [Geographic Area within Nevada].

Reporting

Option A: The Employee will report to [Manager Title].

Option B: The Employee will report to the [Department].

The Employee will submit sales reports [Frequency - e.g., weekly, bi-weekly] in [Format - e.g., written report, CRM system]. Performance reviews will be conducted [Frequency - e.g., quarterly, annually]. Client issues should be escalated to [Whom - e.g., Manager, Customer Service].

Work Location and Fieldwork

Option A: The primary work location is [Company Office Address].

Option B: The position requires extensive fieldwork within the designated territory.

The Employee will be required to [On-site presence, travel between client sites]. The Company will provide [Company-provided equipment - e.g., vehicle, business phone, tablet, sales materials]. Employee is responsible for the care, use, and return of company property.

Employment Status and Hours

Option A: Full-time employment.

Option B: [Consider options for part-time, temporary, or contract roles].

The Employee's scheduled hours are [Number] hours per week. Overtime eligibility will be determined according to FLSA and Nevada law. Rest and meal periods will be provided in accordance with Nevada law. Timekeeping procedures are [Describe procedures].

Compensation

Option A: Base Salary: [Amount] [Annually/Hourly].

Option B: Commission: [Rate] of [Eligible Products/Services]. Commission is calculated [Calculation Method] and paid [Payment Timing].

Option C: Bonus: [Bonus Structure - e.g., monthly, quarterly, annual targets].

Payment Method: [Direct Deposit/Check]. Pay Cycle: [Frequency - e.g., bi-weekly, monthly]. Any clawback or forfeiture provisions related to commissions will comply with Nevada wage payment statutes.

Benefits

Option A: Health Insurance.

Option B: Dental Insurance.

Option C: Vision Insurance.

Option D: Life Insurance.

Option E: 401(k) or similar retirement plan.

Option F: Paid Time Off (Vacation, Sick Leave, Nevada Paid Leave).

Sales-related allowances or reimbursements: [Mileage, Travel Expenses, Meal and Entertainment Costs, Cell Phone/Data Plans]. Reimbursement policies will comply with IRS and Nevada employment guidelines.

Expense Reimbursement

Option A: The Company will reimburse reasonable and necessary business expenses incurred by the Employee in the performance of their duties.

Option B: The Company will provide an expense allowance of [Amount] per [Period].

All expenses must be documented and approved according to Company policy.

Commission Payments on Termination

Option A: Commissions on terminated or closed accounts will be paid according to [Specify criteria and process, adhering to NRS 608.165].

Option B: No commissions will be paid on accounts closed after termination.

Final wage and commission payment will be made according to Nevada law.

Exempt/Non-Exempt Status

Option A: Exempt.

Option B: Non-Exempt.

Employee's exempt or non-exempt status is determined based on FLSA and Nevada law. Appropriate minimum wage and overtime will be paid according to Nevada's tiered minimum wage rates.

Code of Conduct

Option A: The Employee shall adhere to the Company's Code of Conduct.

Option B: The Employee shall maintain professional behavior in all client interactions.

Compliance with anti-bribery and anti-kickback statutes, gift and entertainment policies, and ethical sales conduct is required.

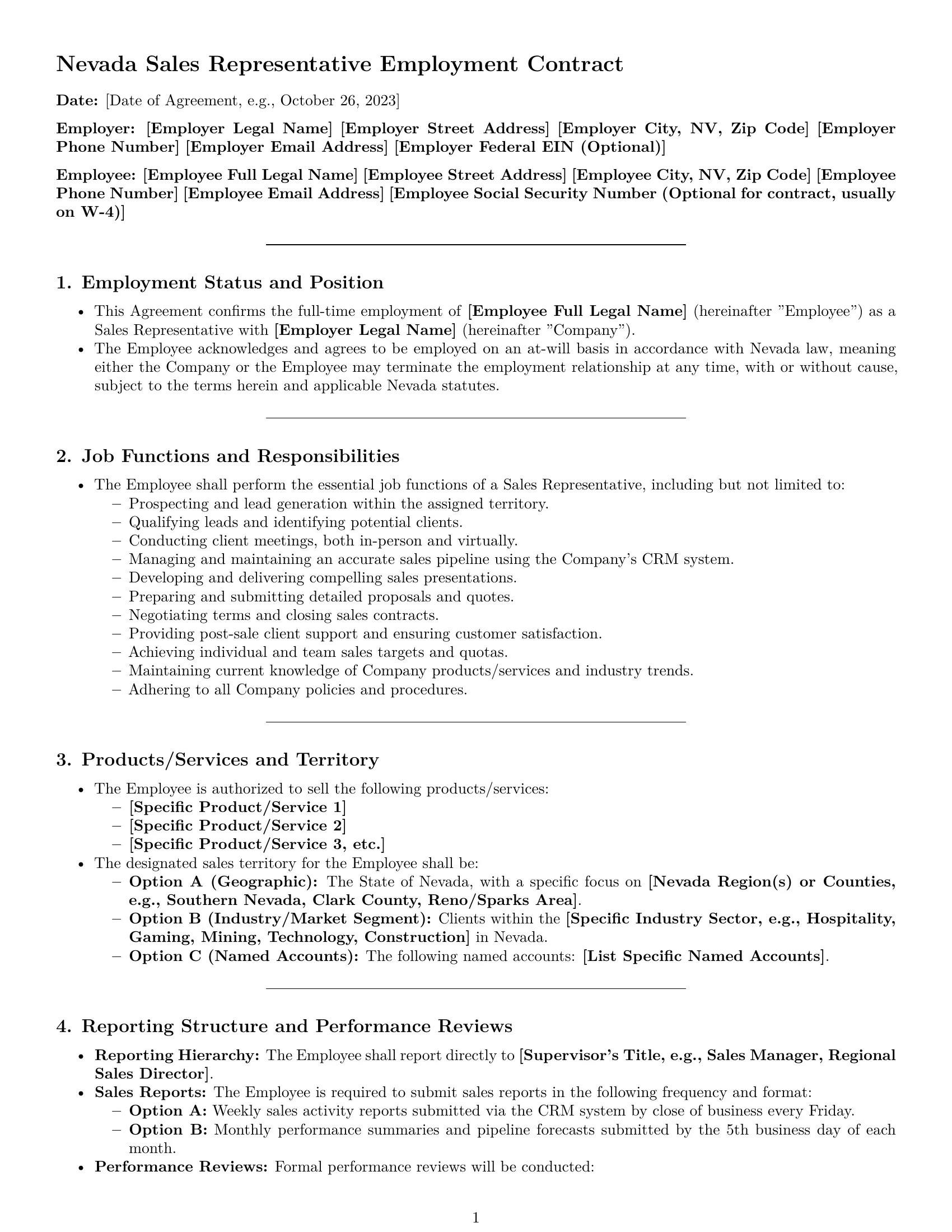

Confidentiality

Option A: The Employee agrees to protect the confidential information of the Company.

Option B: Confidential information includes trade secrets, customer lists, sales strategies, pricing, and market data.

Confidentiality obligations survive employment, as required by the Nevada Uniform Trade Secrets Act.

Ownership of Work Product

Option A: All sales materials, client and prospect data, and related work product created during employment are the property of the Company.

Option B: The Company retains ownership of all intellectual property created by the Employee during the course of employment.

Non-Solicitation/Non-Disclosure

Option A: The Employee agrees not to solicit the Company's clients for a period of [Number] months after termination.

Option B: The Employee agrees not to solicit the Company's employees for a period of [Number] months after termination.

Option C: Non-compete provisions are limited and subject to Nevada law (NRS 613.195).

Restrictions are tailored to customer and employee solicitation within an enforceable scope. "Blue pencil" provisions may apply if allowed.

Employment at Will

Option A: This is an at-will employment relationship.

Option B: The Employee may resign at any time with [Number] days' written notice.

Option C: The Company may terminate the employment at any time, with or without cause.

Grounds for termination, required notices, and procedures for voluntary resignation and involuntary termination will comply with NRS 608.020–050.

Return of Company Property

Option A: Upon termination, the Employee shall return all Company property.

Option B: Company property includes client lists, samples, promotional materials, devices, and records.

Compliance with Laws

Option A: The Employee shall comply with all relevant state and federal industry regulations.

Option B: This includes real estate licensing laws, insurance producer licensing, or financial product rules if applicable, and sales tax requirements under the Nevada Department of Taxation.

Equal Employment Opportunity

Option A: The Company is an equal opportunity employer.

Option B: The Company prohibits discrimination based on race, color, national origin, sex, religion, age, disability, sexual orientation, and gender identity.

Occupational Safety and Workers' Compensation

Option A: The Company complies with Nevada OSHA and NRS 616A-D.

Option B: This includes provisions for automobile use (insurance, accident protocols, cell phone use while driving).

Training

Option A: The Employee is required to complete [Training Requirements].

Option B: Training includes onboarding processes, product knowledge updates, mandatory participation in company sales meetings, quarterly or annual compliance training, and periodic licensing renewal if needed.

Dispute Resolution

Option A: Disputes will be resolved through internal complaint handling, followed by mediation.

Option B: Disputes will be resolved through arbitration.

Choice of law is Nevada. Applicable jurisdiction/venue for disputes is [County, Nevada].

Contract Updates

Option A: This contract may be updated periodically to reflect changes in Nevada law, company policy, or industry sales standards.

Employee Acknowledgement of Rights

Option A: The Employee acknowledges their commission and wage dispute resolution rights under Nevada law.

Option B: Contact information for the Nevada Labor Commissioner is provided in the Employee Handbook.

Amendment

Option A: This contract may be modified or amended in writing with mutual consent.

Integration

Option A: This contract, along with the Company's handbook, commission plan, and ethics policy, constitutes the entire agreement between the parties.

These documents are attached or made available for review.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

[Company Name]

By: [Name]

Title: [Title]

[Employee Name]

Signature:

Date: