Maine accountant employment contract template

View and compare the Free version and the Pro version.

Help Center

Need to learn how to convert downloaded contract DOCX files to PDF or add electronic signatures? Please visit our Help Center for detailed guidance.

How Maine accountant employment contract Differ from Other States

-

Maine requires strict compliance with state-specific wage payment laws, including payment frequency and final wage timing, which may differ from other states.

-

Non-compete agreements in Maine are subject to additional restrictions, such as mandatory advance notice and wage thresholds, not present in many states.

-

Maine mandates specific anti-discrimination clauses in employment contracts that must reference the Maine Human Rights Act, unlike generic U.S. templates.

Frequently Asked Questions (FAQ)

-

Q: Are non-compete clauses enforceable in Maine accountant employment contracts?

A: Yes, but Maine law imposes strict requirements such as minimum salary, advance notice, and reasonableness of restrictions.

-

Q: Does Maine require specific language about overtime for accountants?

A: Yes, employment contracts should address overtime compensation according to Maine’s wage and hour laws or specific exemptions.

-

Q: Must accountant employment contracts in Maine include anti-discrimination provisions?

A: Yes, contracts must comply with the Maine Human Rights Act by including appropriate anti-discrimination language.

HTML Code Preview

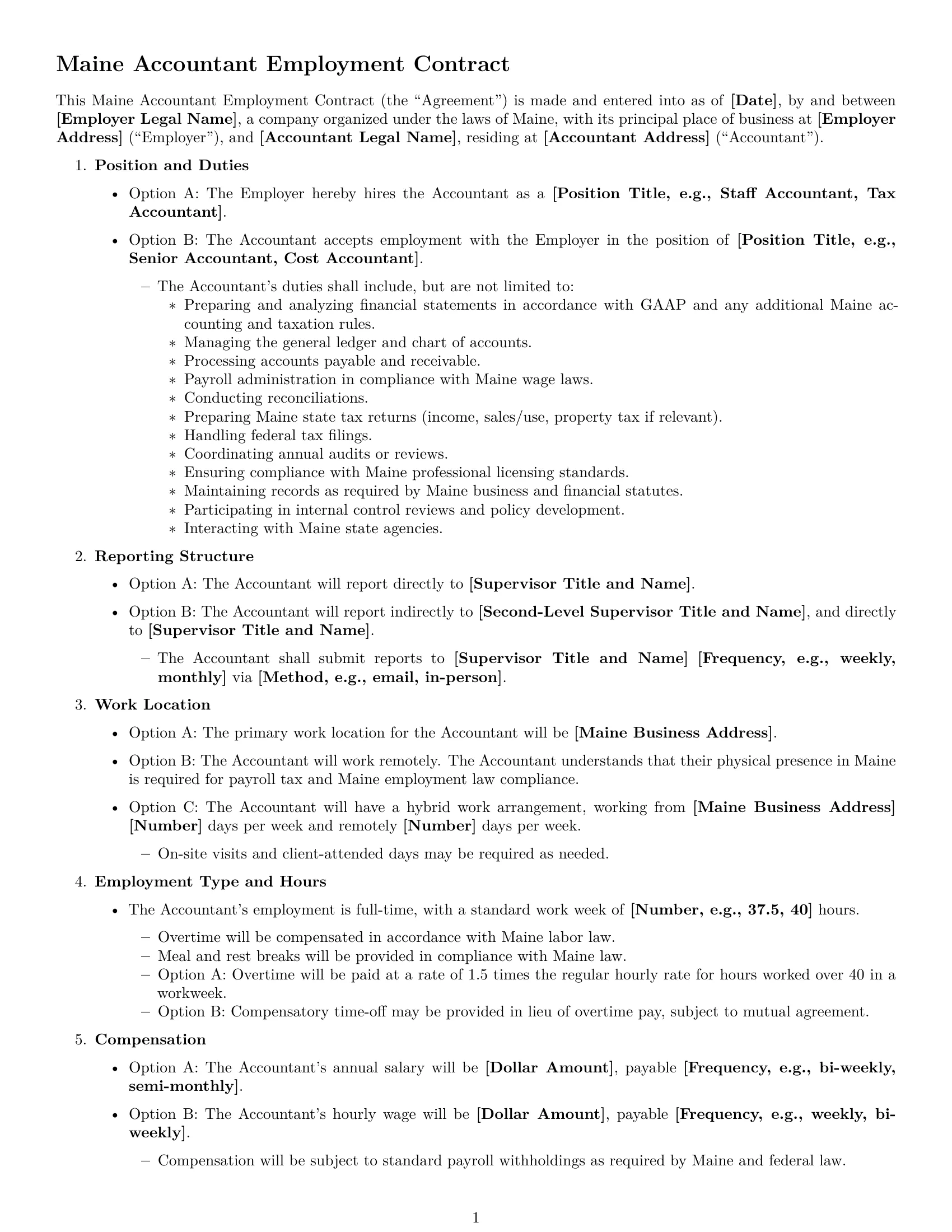

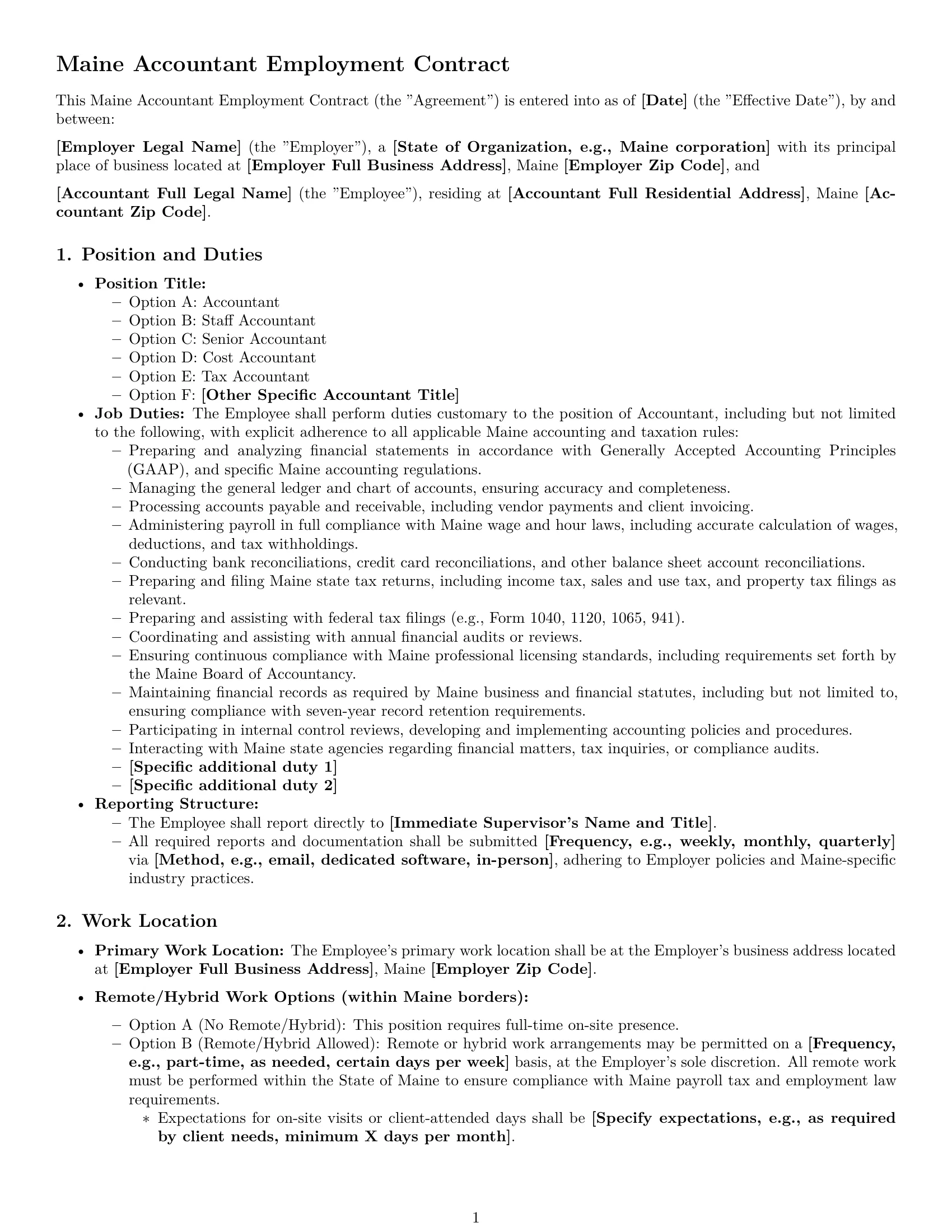

Maine Accountant Employment Contract

This Maine Accountant Employment Contract (the “Agreement”) is made and entered into as of [Date], by and between [Employer Legal Name], a company organized under the laws of Maine, with its principal place of business at [Employer Address] (“Employer”), and [Accountant Legal Name], residing at [Accountant Address] (“Accountant”).

1. Position and Duties

Option A: The Employer hereby hires the Accountant as a [Position Title, e.g., Staff Accountant, Tax Accountant].

Option B: The Accountant accepts employment with the Employer in the position of [Position Title, e.g., Senior Accountant, Cost Accountant].

The Accountant's duties shall include, but are not limited to:

- Preparing and analyzing financial statements in accordance with GAAP and any additional Maine accounting and taxation rules.

- Managing the general ledger and chart of accounts.

- Processing accounts payable and receivable.

- Payroll administration in compliance with Maine wage laws.

- Conducting reconciliations.

- Preparing Maine state tax returns (income, sales/use, property tax if relevant).

- Handling federal tax filings.

- Coordinating annual audits or reviews.

- Ensuring compliance with Maine professional licensing standards.

- Maintaining records as required by Maine business and financial statutes.

- Participating in internal control reviews and policy development.

- Interacting with Maine state agencies.

2. Reporting Structure

Option A: The Accountant will report directly to [Supervisor Title and Name].

Option B: The Accountant will report indirectly to [Second-Level Supervisor Title and Name], and directly to [Supervisor Title and Name].

The Accountant shall submit reports to [Supervisor Title and Name] [Frequency, e.g., weekly, monthly] via [Method, e.g., email, in-person].

3. Work Location

Option A: The primary work location for the Accountant will be [Maine Business Address].

Option B: The Accountant will work remotely. The Accountant understands that their physical presence in Maine is required for payroll tax and Maine employment law compliance.

Option C: The Accountant will have a hybrid work arrangement, working from [Maine Business Address] [Number] days per week and remotely [Number] days per week.

On-site visits and client-attended days may be required as needed.

4. Employment Type and Hours

The Accountant's employment is full-time, with a standard work week of [Number, e.g., 37.5, 40] hours.

Overtime will be compensated in accordance with Maine labor law.

Meal and rest breaks will be provided in compliance with Maine law.

Option A: Overtime will be paid at a rate of 1.5 times the regular hourly rate for hours worked over 40 in a workweek.

Option B: Compensatory time-off may be provided in lieu of overtime pay, subject to mutual agreement.

5. Compensation

Option A: The Accountant's annual salary will be [Dollar Amount], payable [Frequency, e.g., bi-weekly, semi-monthly].

Option B: The Accountant's hourly wage will be [Dollar Amount], payable [Frequency, e.g., weekly, bi-weekly].

Compensation will be subject to standard payroll withholdings as required by Maine and federal law.

Payment will be made via [Method, e.g., direct deposit, check].

The Accountant will receive a check stub detailing all deductions.

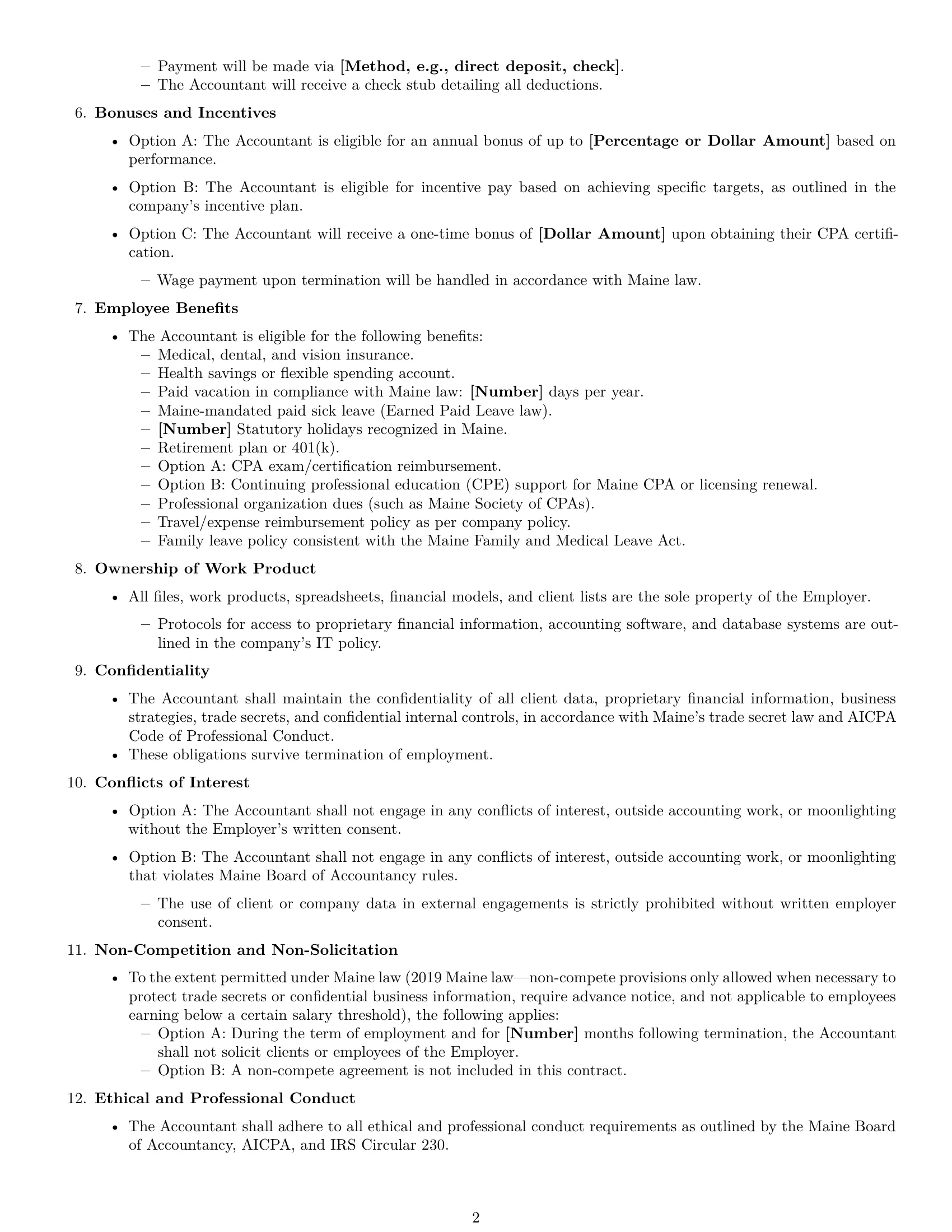

6. Bonuses and Incentives

Option A: The Accountant is eligible for an annual bonus of up to [Percentage or Dollar Amount] based on performance.

Option B: The Accountant is eligible for incentive pay based on achieving specific targets, as outlined in the company's incentive plan.

Option C: The Accountant will receive a one-time bonus of [Dollar Amount] upon obtaining their CPA certification.

Wage payment upon termination will be handled in accordance with Maine law.

7. Employee Benefits

The Accountant is eligible for the following benefits:

- Medical, dental, and vision insurance.

- Health savings or flexible spending account.

- Paid vacation in compliance with Maine law: [Number] days per year.

- Maine-mandated paid sick leave (Earned Paid Leave law).

- [Number] Statutory holidays recognized in Maine.

- Retirement plan or 401(k).

- Option A: CPA exam/certification reimbursement.

- Option B: Continuing professional education (CPE) support for Maine CPA or licensing renewal.

- Professional organization dues (such as Maine Society of CPAs).

- Travel/expense reimbursement policy as per company policy.

- Family leave policy consistent with the Maine Family and Medical Leave Act.

8. Ownership of Work Product

All files, work products, spreadsheets, financial models, and client lists are the sole property of the Employer.

Protocols for access to proprietary financial information, accounting software, and database systems are outlined in the company's IT policy.

9. Confidentiality

The Accountant shall maintain the confidentiality of all client data, proprietary financial information, business strategies, trade secrets, and confidential internal controls, in accordance with Maine's trade secret law and AICPA Code of Professional Conduct.

These obligations survive termination of employment.

10. Conflicts of Interest

Option A: The Accountant shall not engage in any conflicts of interest, outside accounting work, or moonlighting without the Employer's written consent.

Option B: The Accountant shall not engage in any conflicts of interest, outside accounting work, or moonlighting that violates Maine Board of Accountancy rules.

The use of client or company data in external engagements is strictly prohibited without written employer consent.

11. Non-Competition and Non-Solicitation

To the extent permitted under Maine law (2019 Maine law—non-compete provisions only allowed when necessary to protect trade secrets or confidential business information, require advance notice, and not applicable to employees earning below a certain salary threshold), the following applies:

Option A: During the term of employment and for [Number] months following termination, the Accountant shall not solicit clients or employees of the Employer.

Option B: A non-compete agreement is not included in this contract.

12. Ethical and Professional Conduct

The Accountant shall adhere to all ethical and professional conduct requirements as outlined by the Maine Board of Accountancy, AICPA, and IRS Circular 230.

The Accountant shall promptly notify the Employer of any investigation or censure.

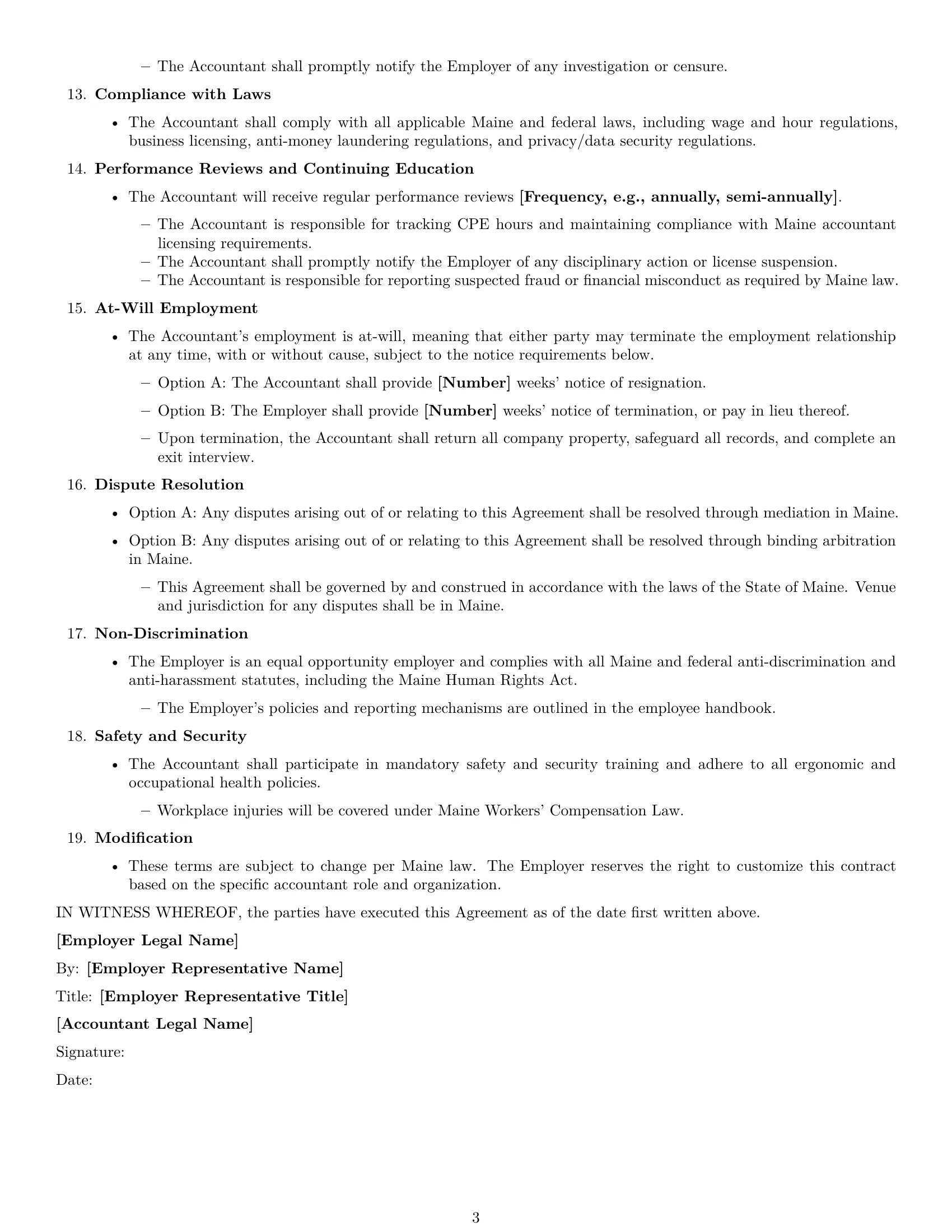

13. Compliance with Laws

The Accountant shall comply with all applicable Maine and federal laws, including wage and hour regulations, business licensing, anti-money laundering regulations, and privacy/data security regulations.

14. Performance Reviews and Continuing Education

The Accountant will receive regular performance reviews [Frequency, e.g., annually, semi-annually].

The Accountant is responsible for tracking CPE hours and maintaining compliance with Maine accountant licensing requirements.

The Accountant shall promptly notify the Employer of any disciplinary action or license suspension.

The Accountant is responsible for reporting suspected fraud or financial misconduct as required by Maine law.

15. At-Will Employment

The Accountant's employment is at-will, meaning that either party may terminate the employment relationship at any time, with or without cause, subject to the notice requirements below.

Option A: The Accountant shall provide [Number] weeks' notice of resignation.

Option B: The Employer shall provide [Number] weeks' notice of termination, or pay in lieu thereof.

Upon termination, the Accountant shall return all company property, safeguard all records, and complete an exit interview.

16. Dispute Resolution

Option A: Any disputes arising out of or relating to this Agreement shall be resolved through mediation in Maine.

Option B: Any disputes arising out of or relating to this Agreement shall be resolved through binding arbitration in Maine.

This Agreement shall be governed by and construed in accordance with the laws of the State of Maine. Venue and jurisdiction for any disputes shall be in Maine.

17. Non-Discrimination

The Employer is an equal opportunity employer and complies with all Maine and federal anti-discrimination and anti-harassment statutes, including the Maine Human Rights Act.

The Employer's policies and reporting mechanisms are outlined in the employee handbook.

18. Safety and Security

The Accountant shall participate in mandatory safety and security training and adhere to all ergonomic and occupational health policies.

Workplace injuries will be covered under Maine Workers' Compensation Law.

19. Modification

These terms are subject to change per Maine law. The Employer reserves the right to customize this contract based on the specific accountant role and organization.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

[Employer Legal Name]

By: [Employer Representative Name]

Title: [Employer Representative Title]

[Accountant Legal Name]

Signature:

Date: