Wyoming limited liability partnership agreement template

View and compare the Free version and the Pro version.

Help Center

Need to learn how to convert downloaded contract DOCX files to PDF or add electronic signatures? Please visit our Help Center for detailed guidance.

How Wyoming limited liability partnership agreement Differ from Other States

-

Wyoming requires LLPs to file annual reports and pay an annual license tax, unlike some states that have different or lower reporting fees.

-

Wyoming provides enhanced privacy as it does not require disclosure of all LLP partners' names in public filings, unlike many other states.

-

Wyoming law offers more flexibility in managing the internal affairs of LLPs, allowing partners to customize their governance structure extensively.

Frequently Asked Questions (FAQ)

-

Q: Does a Wyoming LLP protect all partners from personal liability?

A: Yes, a Wyoming LLP generally shields all partners from personal liability for business debts and obligations, except for individual misconduct.

-

Q: Is a registered agent required for a Wyoming LLP?

A: Yes, Wyoming law requires every LLP to maintain a registered agent with a physical address in the state for legal notifications.

-

Q: How do I maintain my Wyoming LLP's compliance?

A: You must file an annual report, pay the license tax, and keep the LLP’s information current with the Wyoming Secretary of State.

HTML Code Preview

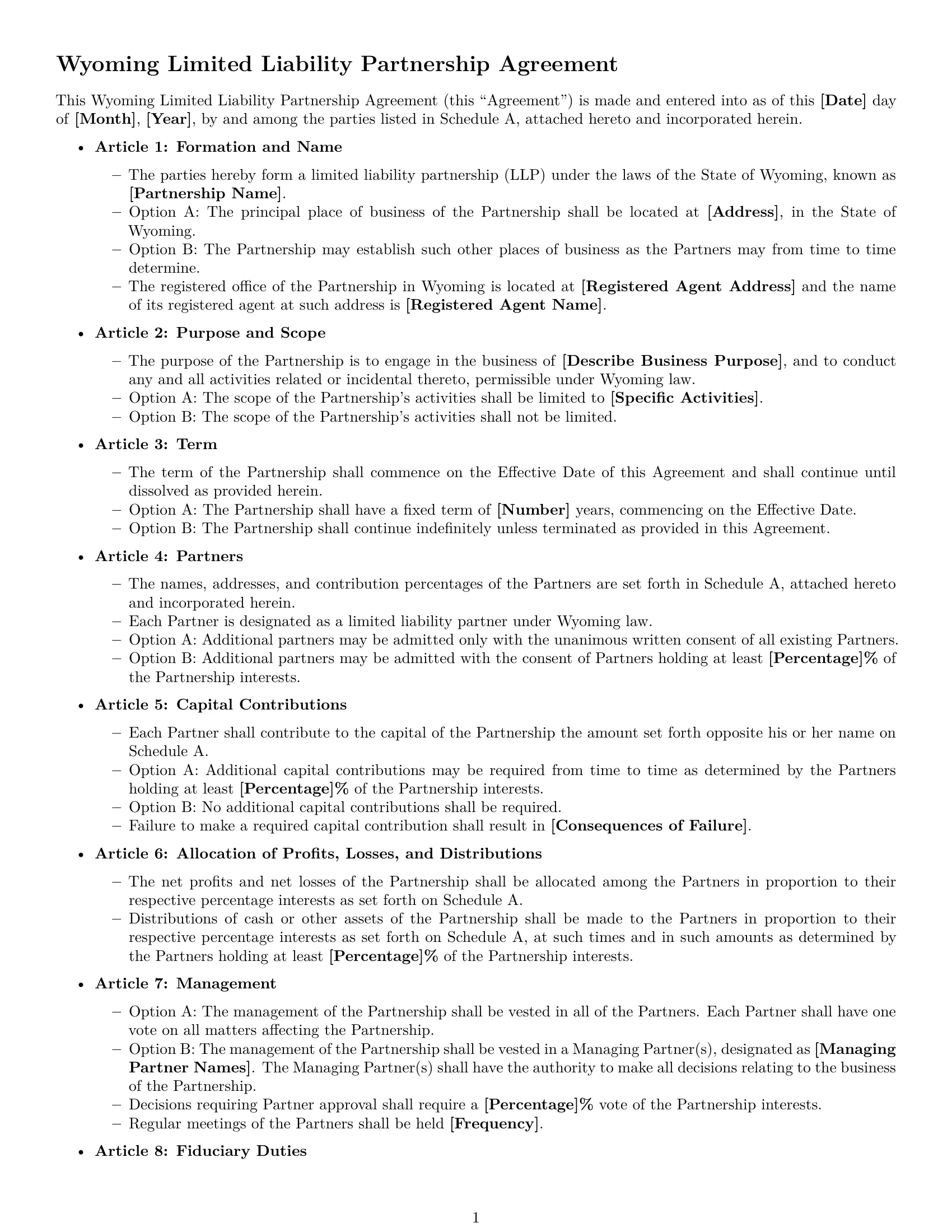

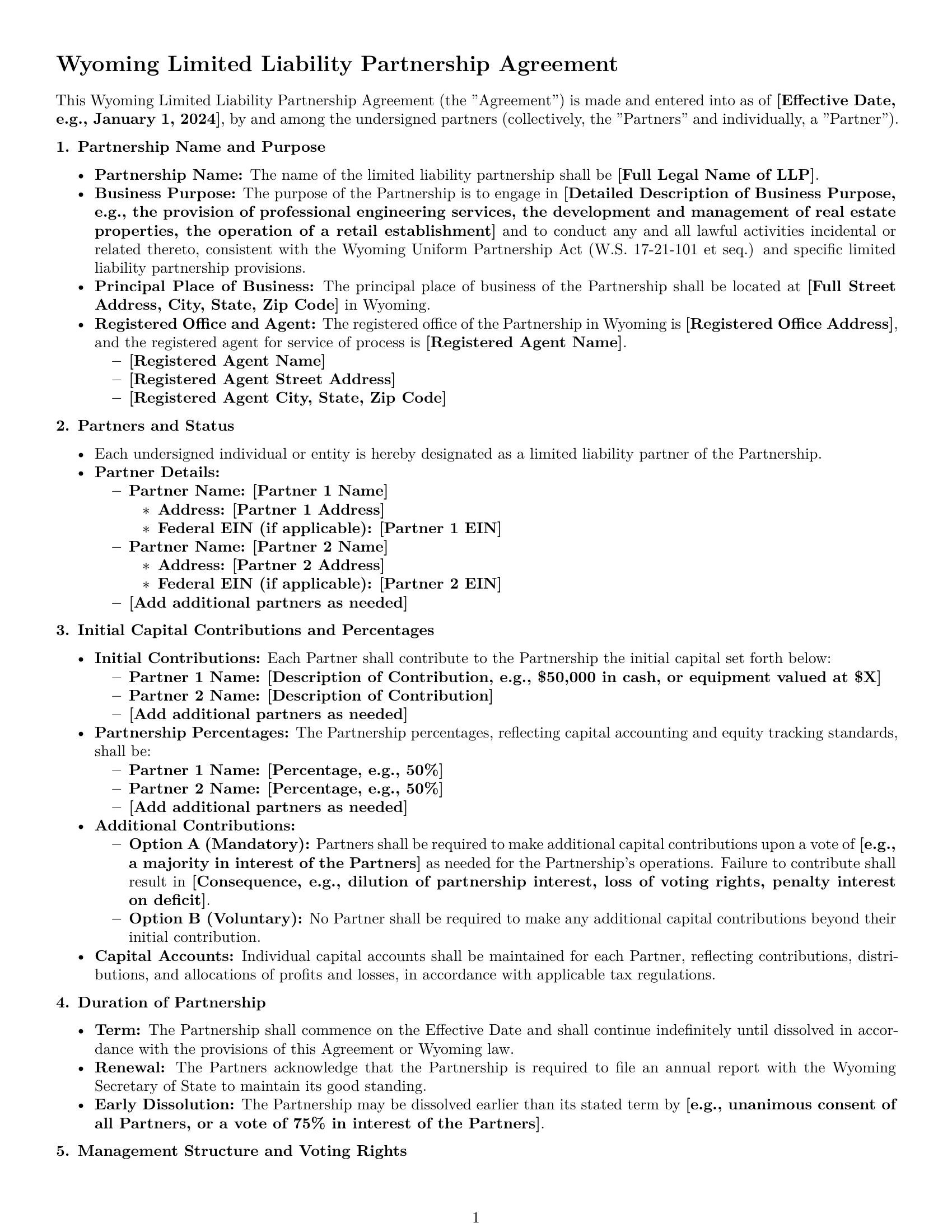

Wyoming Limited Liability Partnership Agreement

This Wyoming Limited Liability Partnership Agreement (this “Agreement”) is made and entered into as of this [Date] day of [Month], [Year], by and among the parties listed in Schedule A, attached hereto and incorporated herein.

Article 1: Formation and Name

- The parties hereby form a limited liability partnership (LLP) under the laws of the State of Wyoming, known as [Partnership Name].

- Option A: The principal place of business of the Partnership shall be located at [Address], in the State of Wyoming.

- Option B: The Partnership may establish such other places of business as the Partners may from time to time determine.

- The registered office of the Partnership in Wyoming is located at [Registered Agent Address] and the name of its registered agent at such address is [Registered Agent Name].

Article 2: Purpose and Scope

- The purpose of the Partnership is to engage in the business of [Describe Business Purpose], and to conduct any and all activities related or incidental thereto, permissible under Wyoming law.

- Option A: The scope of the Partnership's activities shall be limited to [Specific Activities].

- Option B: The scope of the Partnership's activities shall not be limited.

Article 3: Term

- The term of the Partnership shall commence on the Effective Date of this Agreement and shall continue until dissolved as provided herein.

- Option A: The Partnership shall have a fixed term of [Number] years, commencing on the Effective Date.

- Option B: The Partnership shall continue indefinitely unless terminated as provided in this Agreement.

Article 4: Partners

- The names, addresses, and contribution percentages of the Partners are set forth in Schedule A, attached hereto and incorporated herein.

- Each Partner is designated as a limited liability partner under Wyoming law.

- Option A: Additional partners may be admitted only with the unanimous written consent of all existing Partners.

- Option B: Additional partners may be admitted with the consent of Partners holding at least [Percentage]% of the Partnership interests.

Article 5: Capital Contributions

- Each Partner shall contribute to the capital of the Partnership the amount set forth opposite his or her name on Schedule A.

- Option A: Additional capital contributions may be required from time to time as determined by the Partners holding at least [Percentage]% of the Partnership interests.

- Option B: No additional capital contributions shall be required.

- Failure to make a required capital contribution shall result in [Consequences of Failure].

Article 6: Allocation of Profits, Losses, and Distributions

- The net profits and net losses of the Partnership shall be allocated among the Partners in proportion to their respective percentage interests as set forth on Schedule A.

- Distributions of cash or other assets of the Partnership shall be made to the Partners in proportion to their respective percentage interests as set forth on Schedule A, at such times and in such amounts as determined by the Partners holding at least [Percentage]% of the Partnership interests.

Article 7: Management

- Option A: The management of the Partnership shall be vested in all of the Partners. Each Partner shall have one vote on all matters affecting the Partnership.

- Option B: The management of the Partnership shall be vested in a Managing Partner(s), designated as [Managing Partner Names]. The Managing Partner(s) shall have the authority to make all decisions relating to the business of the Partnership.

- Decisions requiring Partner approval shall require a [Percentage]% vote of the Partnership interests.

- Regular meetings of the Partners shall be held [Frequency].

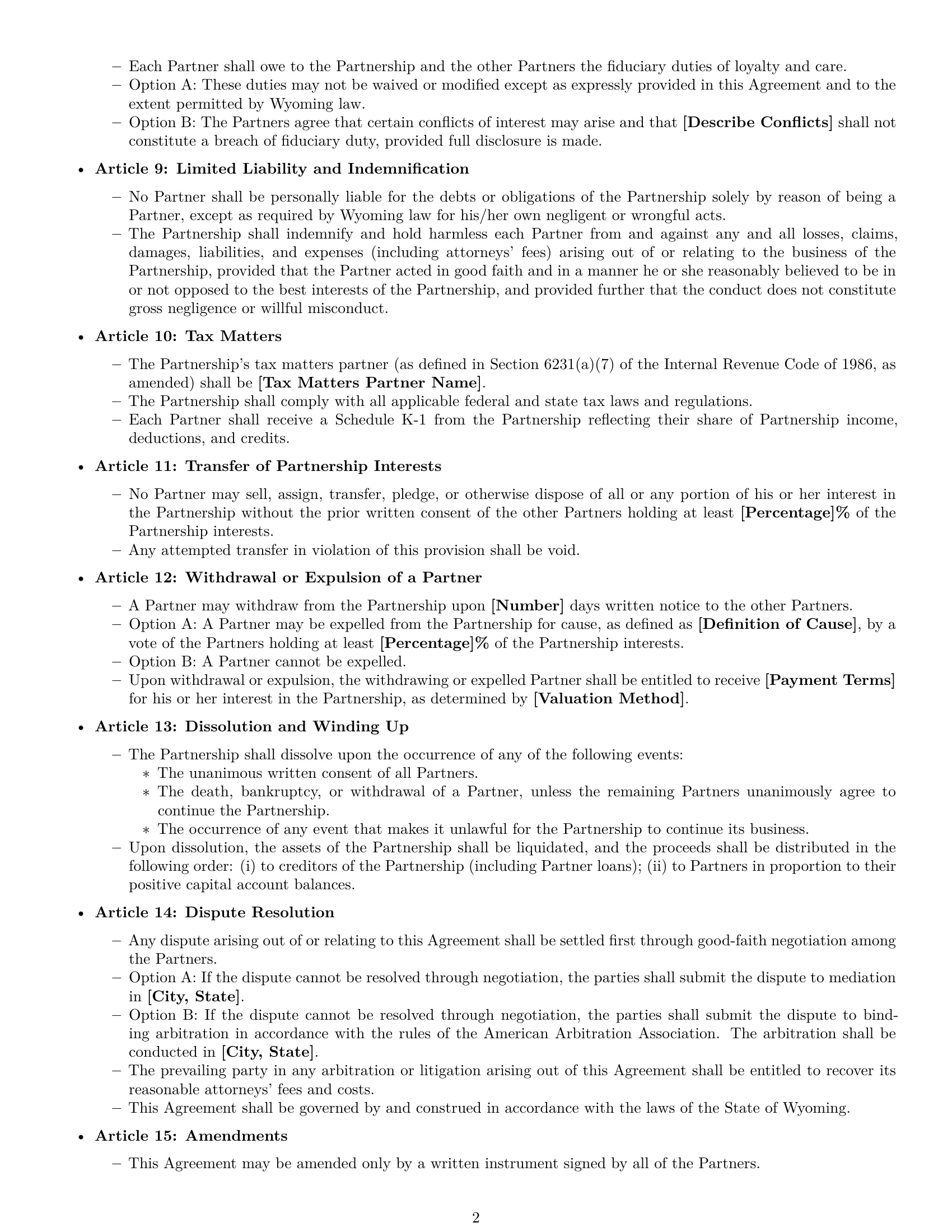

Article 8: Fiduciary Duties

- Each Partner shall owe to the Partnership and the other Partners the fiduciary duties of loyalty and care.

- Option A: These duties may not be waived or modified except as expressly provided in this Agreement and to the extent permitted by Wyoming law.

- Option B: The Partners agree that certain conflicts of interest may arise and that [Describe Conflicts] shall not constitute a breach of fiduciary duty, provided full disclosure is made.

Article 9: Limited Liability and Indemnification

- No Partner shall be personally liable for the debts or obligations of the Partnership solely by reason of being a Partner, except as required by Wyoming law for his/her own negligent or wrongful acts.

- The Partnership shall indemnify and hold harmless each Partner from and against any and all losses, claims, damages, liabilities, and expenses (including attorneys' fees) arising out of or relating to the business of the Partnership, provided that the Partner acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of the Partnership, and provided further that the conduct does not constitute gross negligence or willful misconduct.

Article 10: Tax Matters

- The Partnership's tax matters partner (as defined in Section 6231(a)(7) of the Internal Revenue Code of 1986, as amended) shall be [Tax Matters Partner Name].

- The Partnership shall comply with all applicable federal and state tax laws and regulations.

- Each Partner shall receive a Schedule K-1 from the Partnership reflecting their share of Partnership income, deductions, and credits.

Article 11: Transfer of Partnership Interests

- No Partner may sell, assign, transfer, pledge, or otherwise dispose of all or any portion of his or her interest in the Partnership without the prior written consent of the other Partners holding at least [Percentage]% of the Partnership interests.

- Any attempted transfer in violation of this provision shall be void.

Article 12: Withdrawal or Expulsion of a Partner

- A Partner may withdraw from the Partnership upon [Number] days written notice to the other Partners.

- Option A: A Partner may be expelled from the Partnership for cause, as defined as [Definition of Cause], by a vote of the Partners holding at least [Percentage]% of the Partnership interests.

- Option B: A Partner cannot be expelled.

- Upon withdrawal or expulsion, the withdrawing or expelled Partner shall be entitled to receive [Payment Terms] for his or her interest in the Partnership, as determined by [Valuation Method].

Article 13: Dissolution and Winding Up

- The Partnership shall dissolve upon the occurrence of any of the following events:

- The unanimous written consent of all Partners.

- The death, bankruptcy, or withdrawal of a Partner, unless the remaining Partners unanimously agree to continue the Partnership.

- The occurrence of any event that makes it unlawful for the Partnership to continue its business.

- Upon dissolution, the assets of the Partnership shall be liquidated, and the proceeds shall be distributed in the following order: (i) to creditors of the Partnership (including Partner loans); (ii) to Partners in proportion to their positive capital account balances.

Article 14: Dispute Resolution

- Any dispute arising out of or relating to this Agreement shall be settled first through good-faith negotiation among the Partners.

- Option A: If the dispute cannot be resolved through negotiation, the parties shall submit the dispute to mediation in [City, State].

- Option B: If the dispute cannot be resolved through negotiation, the parties shall submit the dispute to binding arbitration in accordance with the rules of the American Arbitration Association. The arbitration shall be conducted in [City, State].

- The prevailing party in any arbitration or litigation arising out of this Agreement shall be entitled to recover its reasonable attorneys' fees and costs.

- This Agreement shall be governed by and construed in accordance with the laws of the State of Wyoming.

Article 15: Amendments

This Agreement may be amended only by a written instrument signed by all of the Partners.

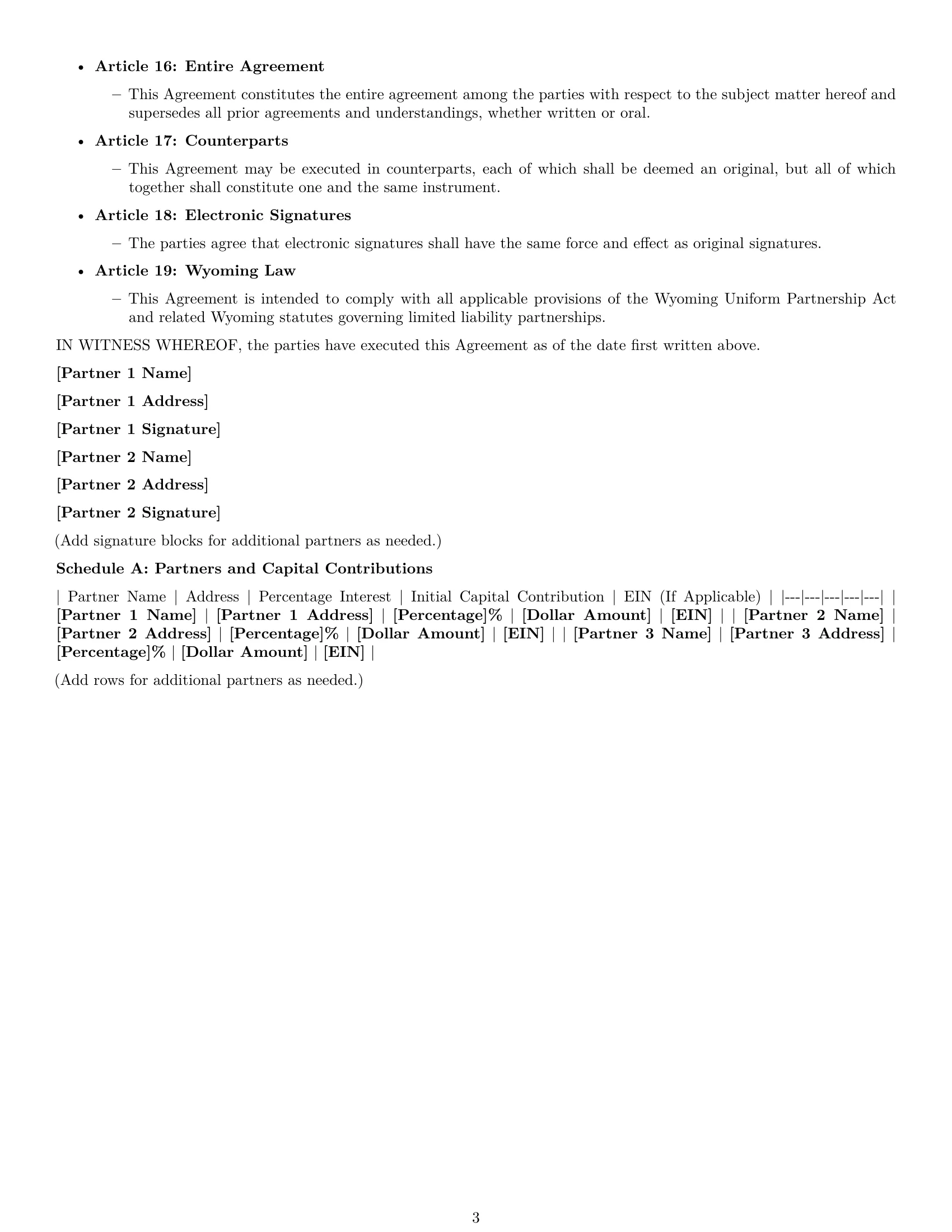

Article 16: Entire Agreement

This Agreement constitutes the entire agreement among the parties with respect to the subject matter hereof and supersedes all prior agreements and understandings, whether written or oral.

Article 17: Counterparts

This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

Article 18: Electronic Signatures

The parties agree that electronic signatures shall have the same force and effect as original signatures.

Article 19: Wyoming Law

This Agreement is intended to comply with all applicable provisions of the Wyoming Uniform Partnership Act and related Wyoming statutes governing limited liability partnerships.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

[Partner 1 Name]

[Partner 1 Address]

[Partner 1 Signature]

[Partner 2 Name]

[Partner 2 Address]

[Partner 2 Signature]

(Add signature blocks for additional partners as needed.)

Schedule A: Partners and Capital Contributions

| Partner Name | Address | Percentage Interest | Initial Capital Contribution | EIN (If Applicable) |

| [Partner 1 Name] | [Partner 1 Address] | [Percentage]% | [Dollar Amount] | [EIN] |

| [Partner 2 Name] | [Partner 2 Address] | [Percentage]% | [Dollar Amount] | [EIN] |

| [Partner 3 Name] | [Partner 3 Address] | [Percentage]% | [Dollar Amount] | [EIN] |

(Add rows for additional partners as needed.)