Pennsylvania limited partnership agreement template

View and compare the Free version and the Pro version.

Help Center

Need to learn how to convert downloaded contract DOCX files to PDF or add electronic signatures? Please visit our Help Center for detailed guidance.

How Pennsylvania limited partnership agreement Differ from Other States

-

Pennsylvania limited partnerships must register with the Department of State in compliance with the Pennsylvania Uniform Limited Partnership Act (ULPA 2016), which may differ in requirements from other states.

-

Unique to Pennsylvania, certain annual tax and reporting obligations apply to limited partnerships that may not be required or may differ in other jurisdictions.

-

Pennsylvania law allows optional inclusion of certain fiduciary duties and specific statutory protections for limited partners, which can differ substantially from the norms across other states.

Frequently Asked Questions (FAQ)

-

Q: Is filing with the Pennsylvania Department of State required to form a limited partnership?

A: Yes, Pennsylvania law mandates the filing of a Certificate of Limited Partnership with the Department of State to form a limited partnership.

-

Q: Can a limited partnership in Pennsylvania have just one general partner?

A: Yes, Pennsylvania law allows a limited partnership to be formed with at least one general partner and one limited partner.

-

Q: Do Pennsylvania limited partnerships need an operating agreement?

A: While not legally required, having a written partnership agreement is highly recommended to clearly outline rights and obligations.

HTML Code Preview

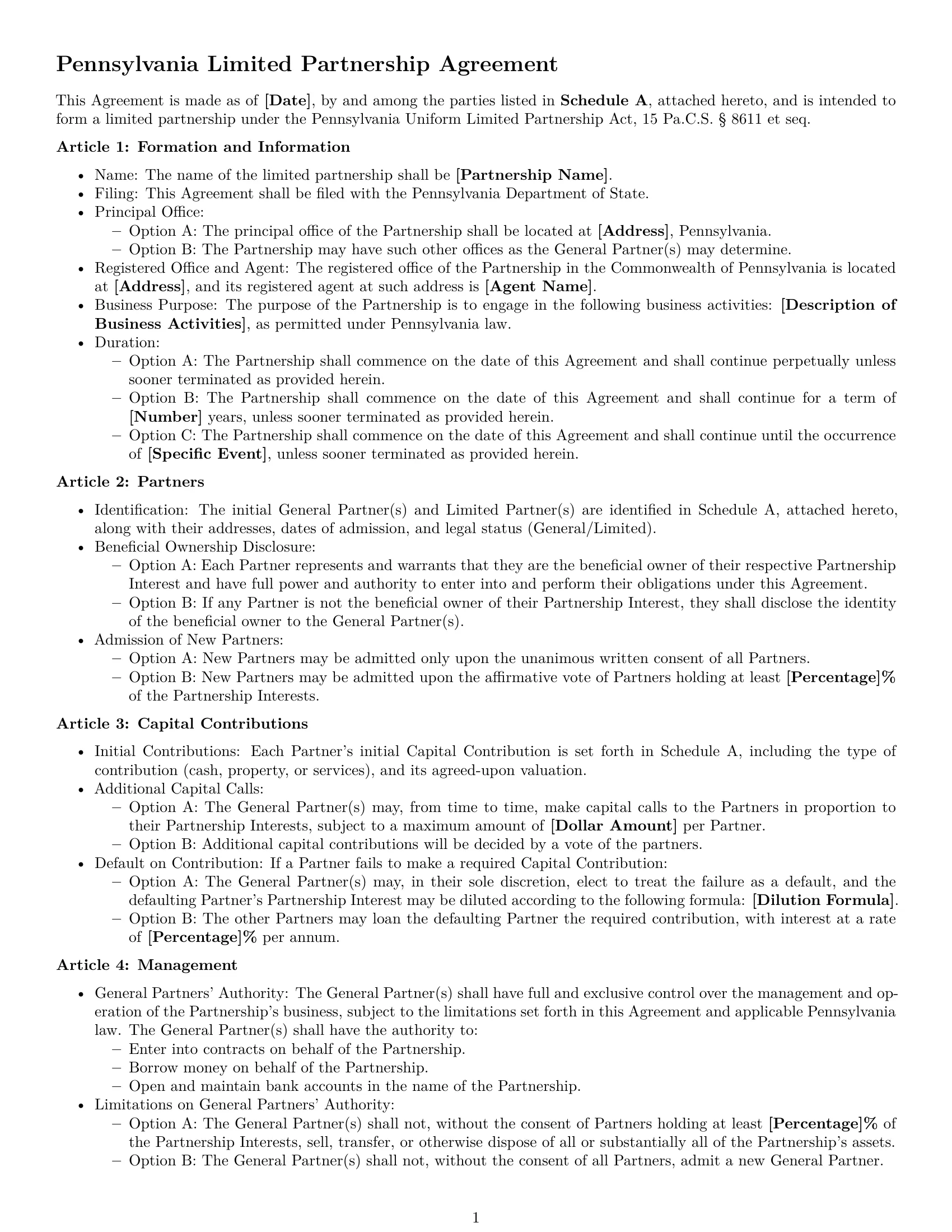

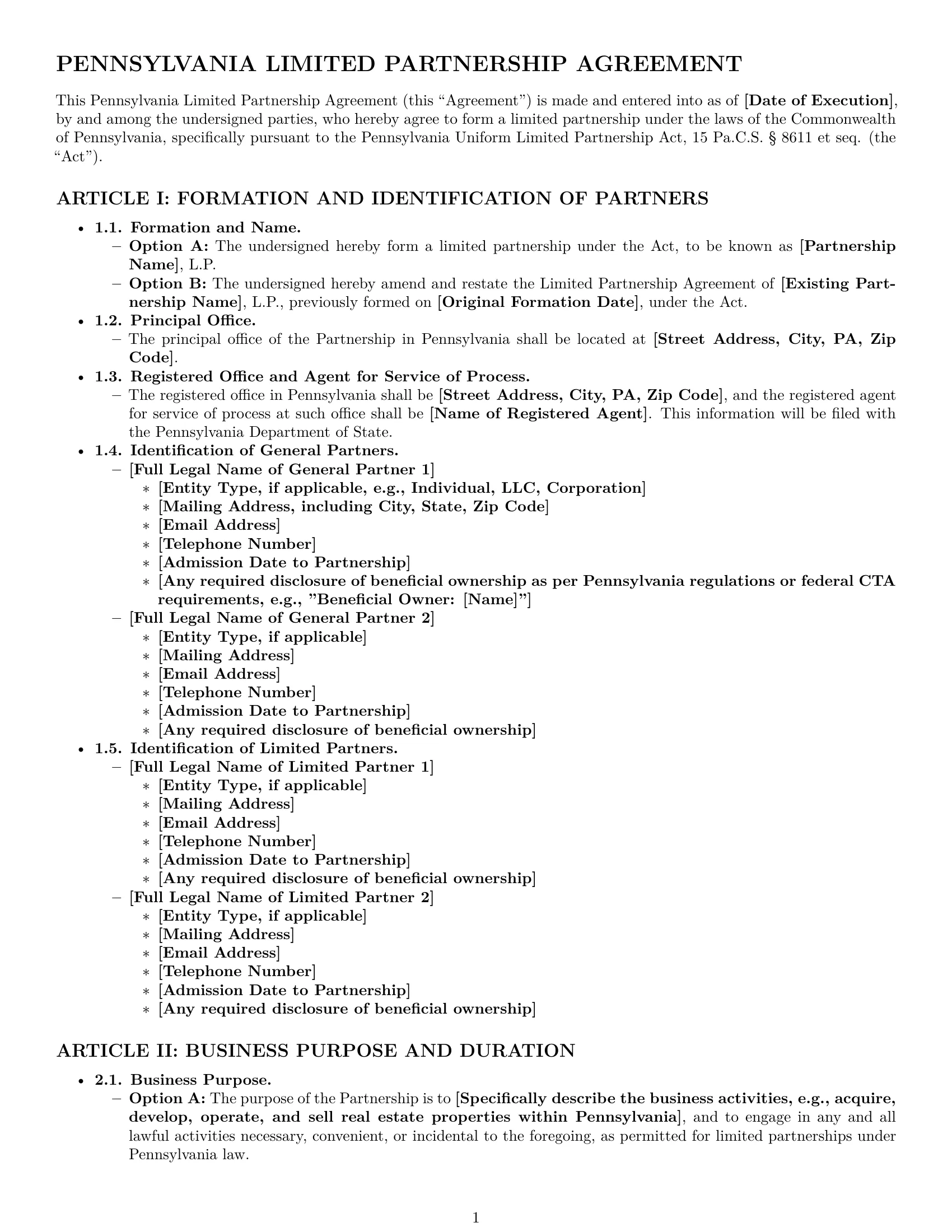

Pennsylvania Limited Partnership Agreement

This Agreement is made as of [Date], by and among the parties listed in Schedule A, attached hereto, and is intended to form a limited partnership under the Pennsylvania Uniform Limited Partnership Act, 15 Pa.C.S. § 8611 et seq.

Article 1: Formation and Information

- Name: The name of the limited partnership shall be [Partnership Name].

- Filing: This Agreement shall be filed with the Pennsylvania Department of State.

- Principal Office:

- Option A: The principal office of the Partnership shall be located at [Address], Pennsylvania.

- Option B: The Partnership may have such other offices as the General Partner(s) may determine.

- Registered Office and Agent: The registered office of the Partnership in the Commonwealth of Pennsylvania is located at [Address], and its registered agent at such address is [Agent Name].

- Business Purpose: The purpose of the Partnership is to engage in the following business activities: [Description of Business Activities], as permitted under Pennsylvania law.

- Duration:

- Option A: The Partnership shall commence on the date of this Agreement and shall continue perpetually unless sooner terminated as provided herein.

- Option B: The Partnership shall commence on the date of this Agreement and shall continue for a term of [Number] years, unless sooner terminated as provided herein.

- Option C: The Partnership shall commence on the date of this Agreement and shall continue until the occurrence of [Specific Event], unless sooner terminated as provided herein.

Article 2: Partners

- Identification: The initial General Partner(s) and Limited Partner(s) are identified in Schedule A, attached hereto, along with their addresses, dates of admission, and legal status (General/Limited).

- Beneficial Ownership Disclosure:

- Option A: Each Partner represents and warrants that they are the beneficial owner of their respective Partnership Interest and have full power and authority to enter into and perform their obligations under this Agreement.

- Option B: If any Partner is not the beneficial owner of their Partnership Interest, they shall disclose the identity of the beneficial owner to the General Partner(s).

- Admission of New Partners:

- Option A: New Partners may be admitted only upon the unanimous written consent of all Partners.

- Option B: New Partners may be admitted upon the affirmative vote of Partners holding at least [Percentage]% of the Partnership Interests.

Article 3: Capital Contributions

- Initial Contributions: Each Partner's initial Capital Contribution is set forth in Schedule A, including the type of contribution (cash, property, or services), and its agreed-upon valuation.

- Additional Capital Calls:

- Option A: The General Partner(s) may, from time to time, make capital calls to the Partners in proportion to their Partnership Interests, subject to a maximum amount of [Dollar Amount] per Partner.

- Option B: Additional capital contributions will be decided by a vote of the partners.

- Default on Contribution: If a Partner fails to make a required Capital Contribution:

- Option A: The General Partner(s) may, in their sole discretion, elect to treat the failure as a default, and the defaulting Partner's Partnership Interest may be diluted according to the following formula: [Dilution Formula].

- Option B: The other Partners may loan the defaulting Partner the required contribution, with interest at a rate of [Percentage]% per annum.

Article 4: Management

- General Partners' Authority: The General Partner(s) shall have full and exclusive control over the management and operation of the Partnership’s business, subject to the limitations set forth in this Agreement and applicable Pennsylvania law. The General Partner(s) shall have the authority to:

- Enter into contracts on behalf of the Partnership.

- Borrow money on behalf of the Partnership.

- Open and maintain bank accounts in the name of the Partnership.

- Limitations on General Partners' Authority:

- Option A: The General Partner(s) shall not, without the consent of Partners holding at least [Percentage]% of the Partnership Interests, sell, transfer, or otherwise dispose of all or substantially all of the Partnership's assets.

- Option B: The General Partner(s) shall not, without the consent of all Partners, admit a new General Partner.

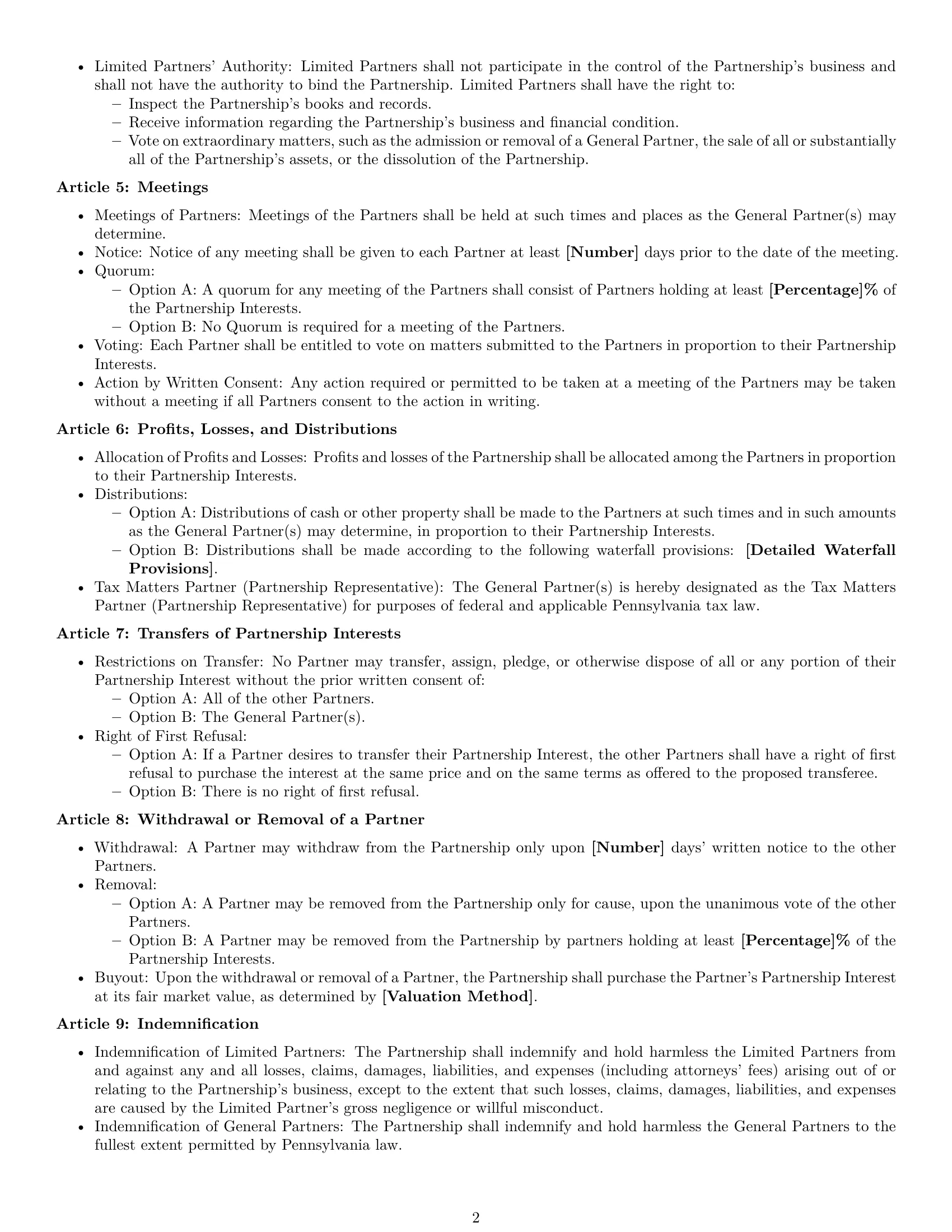

- Limited Partners' Authority: Limited Partners shall not participate in the control of the Partnership's business and shall not have the authority to bind the Partnership. Limited Partners shall have the right to:

- Inspect the Partnership's books and records.

- Receive information regarding the Partnership's business and financial condition.

- Vote on extraordinary matters, such as the admission or removal of a General Partner, the sale of all or substantially all of the Partnership's assets, or the dissolution of the Partnership.

Article 5: Meetings

- Meetings of Partners: Meetings of the Partners shall be held at such times and places as the General Partner(s) may determine.

- Notice: Notice of any meeting shall be given to each Partner at least [Number] days prior to the date of the meeting.

- Quorum:

- Option A: A quorum for any meeting of the Partners shall consist of Partners holding at least [Percentage]% of the Partnership Interests.

- Option B: No Quorum is required for a meeting of the Partners.

- Voting: Each Partner shall be entitled to vote on matters submitted to the Partners in proportion to their Partnership Interests.

- Action by Written Consent: Any action required or permitted to be taken at a meeting of the Partners may be taken without a meeting if all Partners consent to the action in writing.

Article 6: Profits, Losses, and Distributions

- Allocation of Profits and Losses: Profits and losses of the Partnership shall be allocated among the Partners in proportion to their Partnership Interests.

- Distributions:

- Option A: Distributions of cash or other property shall be made to the Partners at such times and in such amounts as the General Partner(s) may determine, in proportion to their Partnership Interests.

- Option B: Distributions shall be made according to the following waterfall provisions: [Detailed Waterfall Provisions].

- Tax Matters Partner (Partnership Representative): The General Partner(s) is hereby designated as the Tax Matters Partner (Partnership Representative) for purposes of federal and applicable Pennsylvania tax law.

Article 7: Transfers of Partnership Interests

- Restrictions on Transfer: No Partner may transfer, assign, pledge, or otherwise dispose of all or any portion of their Partnership Interest without the prior written consent of:

- Option A: All of the other Partners.

- Option B: The General Partner(s).

- Right of First Refusal:

- Option A: If a Partner desires to transfer their Partnership Interest, the other Partners shall have a right of first refusal to purchase the interest at the same price and on the same terms as offered to the proposed transferee.

- Option B: There is no right of first refusal.

Article 8: Withdrawal or Removal of a Partner

- Withdrawal: A Partner may withdraw from the Partnership only upon [Number] days' written notice to the other Partners.

- Removal:

- Option A: A Partner may be removed from the Partnership only for cause, upon the unanimous vote of the other Partners.

- Option B: A Partner may be removed from the Partnership by partners holding at least [Percentage]% of the Partnership Interests.

- Buyout: Upon the withdrawal or removal of a Partner, the Partnership shall purchase the Partner's Partnership Interest at its fair market value, as determined by [Valuation Method].

Article 9: Indemnification

- Indemnification of Limited Partners: The Partnership shall indemnify and hold harmless the Limited Partners from and against any and all losses, claims, damages, liabilities, and expenses (including attorneys' fees) arising out of or relating to the Partnership's business, except to the extent that such losses, claims, damages, liabilities, and expenses are caused by the Limited Partner's gross negligence or willful misconduct.

- Indemnification of General Partners: The Partnership shall indemnify and hold harmless the General Partners to the fullest extent permitted by Pennsylvania law.

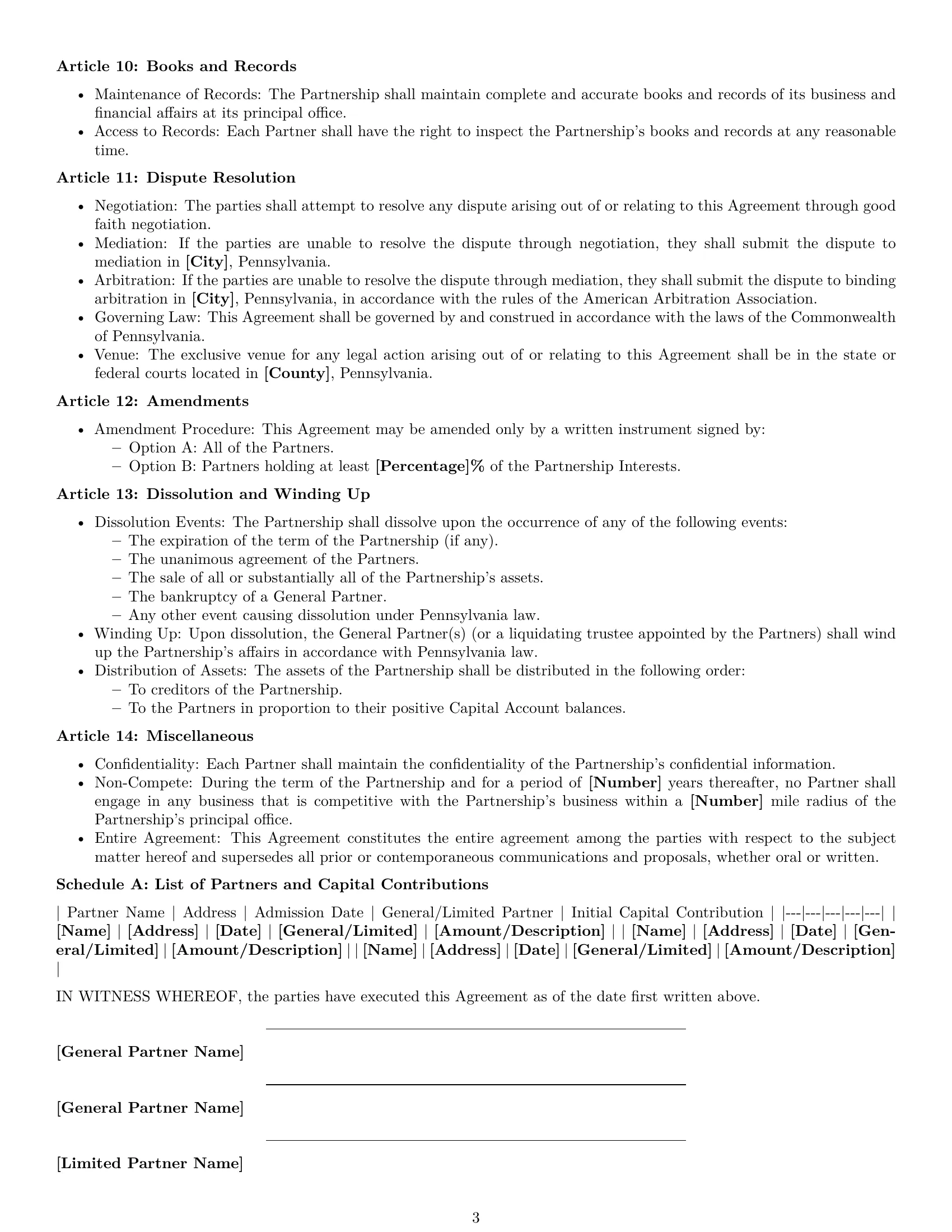

Article 10: Books and Records

- Maintenance of Records: The Partnership shall maintain complete and accurate books and records of its business and financial affairs at its principal office.

- Access to Records: Each Partner shall have the right to inspect the Partnership's books and records at any reasonable time.

Article 11: Dispute Resolution

- Negotiation: The parties shall attempt to resolve any dispute arising out of or relating to this Agreement through good faith negotiation.

- Mediation: If the parties are unable to resolve the dispute through negotiation, they shall submit the dispute to mediation in [City], Pennsylvania.

- Arbitration: If the parties are unable to resolve the dispute through mediation, they shall submit the dispute to binding arbitration in [City], Pennsylvania, in accordance with the rules of the American Arbitration Association.

- Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the Commonwealth of Pennsylvania.

- Venue: The exclusive venue for any legal action arising out of or relating to this Agreement shall be in the state or federal courts located in [County], Pennsylvania.

Article 12: Amendments

- Amendment Procedure: This Agreement may be amended only by a written instrument signed by:

- Option A: All of the Partners.

- Option B: Partners holding at least [Percentage]% of the Partnership Interests.

Article 13: Dissolution and Winding Up

- Dissolution Events: The Partnership shall dissolve upon the occurrence of any of the following events:

- The expiration of the term of the Partnership (if any).

- The unanimous agreement of the Partners.

- The sale of all or substantially all of the Partnership's assets.

- The bankruptcy of a General Partner.

- Any other event causing dissolution under Pennsylvania law.

- Winding Up: Upon dissolution, the General Partner(s) (or a liquidating trustee appointed by the Partners) shall wind up the Partnership's affairs in accordance with Pennsylvania law.

- Distribution of Assets: The assets of the Partnership shall be distributed in the following order:

- To creditors of the Partnership.

- To the Partners in proportion to their positive Capital Account balances.

Article 14: Miscellaneous

- Confidentiality: Each Partner shall maintain the confidentiality of the Partnership's confidential information.

- Non-Compete: During the term of the Partnership and for a period of [Number] years thereafter, no Partner shall engage in any business that is competitive with the Partnership's business within a [Number] mile radius of the Partnership's principal office.

- Entire Agreement: This Agreement constitutes the entire agreement among the parties with respect to the subject matter hereof and supersedes all prior or contemporaneous communications and proposals, whether oral or written.

Schedule A: List of Partners and Capital Contributions

| Partner Name | Address | Admission Date | General/Limited Partner | Initial Capital Contribution |

| [Name] | [Address] | [Date] | [General/Limited] | [Amount/Description] |

| [Name] | [Address] | [Date] | [General/Limited] | [Amount/Description] |

| [Name] | [Address] | [Date] | [General/Limited] | [Amount/Description] |

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

____________________________

[General Partner Name]

____________________________

[General Partner Name]

____________________________

[Limited Partner Name]

____________________________

[Limited Partner Name]