Oregon retail lease agreement template

View and compare the Free version and the Pro version.

Help Center

Need to learn how to convert downloaded contract DOCX files to PDF or add electronic signatures? Please visit our Help Center for detailed guidance.

How Oregon retail lease agreement Differ from Other States

-

Oregon retail leases must comply with unique environmental regulations, particularly regarding hazardous material disclosures, which may differ from requirements in other states.

-

Oregon law permits more flexibility for rental increases in commercial leases, but mandates written notice periods that are specific to the state.

-

Unlike some states, Oregon lease agreements commonly require adherence to state-specific notice and remedy periods before pursuing legal action for default.

Frequently Asked Questions (FAQ)

-

Q: Is a written lease agreement required for retail leases in Oregon?

A: While not legally required, a written lease is strongly recommended to protect both parties and outline specific lease terms.

-

Q: Are triple net (NNN) leases common for Oregon retail properties?

A: Yes, triple net leases are common in Oregon, but lease types can vary—always review the document for expense allocation.

-

Q: What disclosure requirements are specific to Oregon retail leases?

A: Oregon may require disclosure of asbestos, mold, or hazardous materials, in addition to general property condition disclosures.

HTML Code Preview

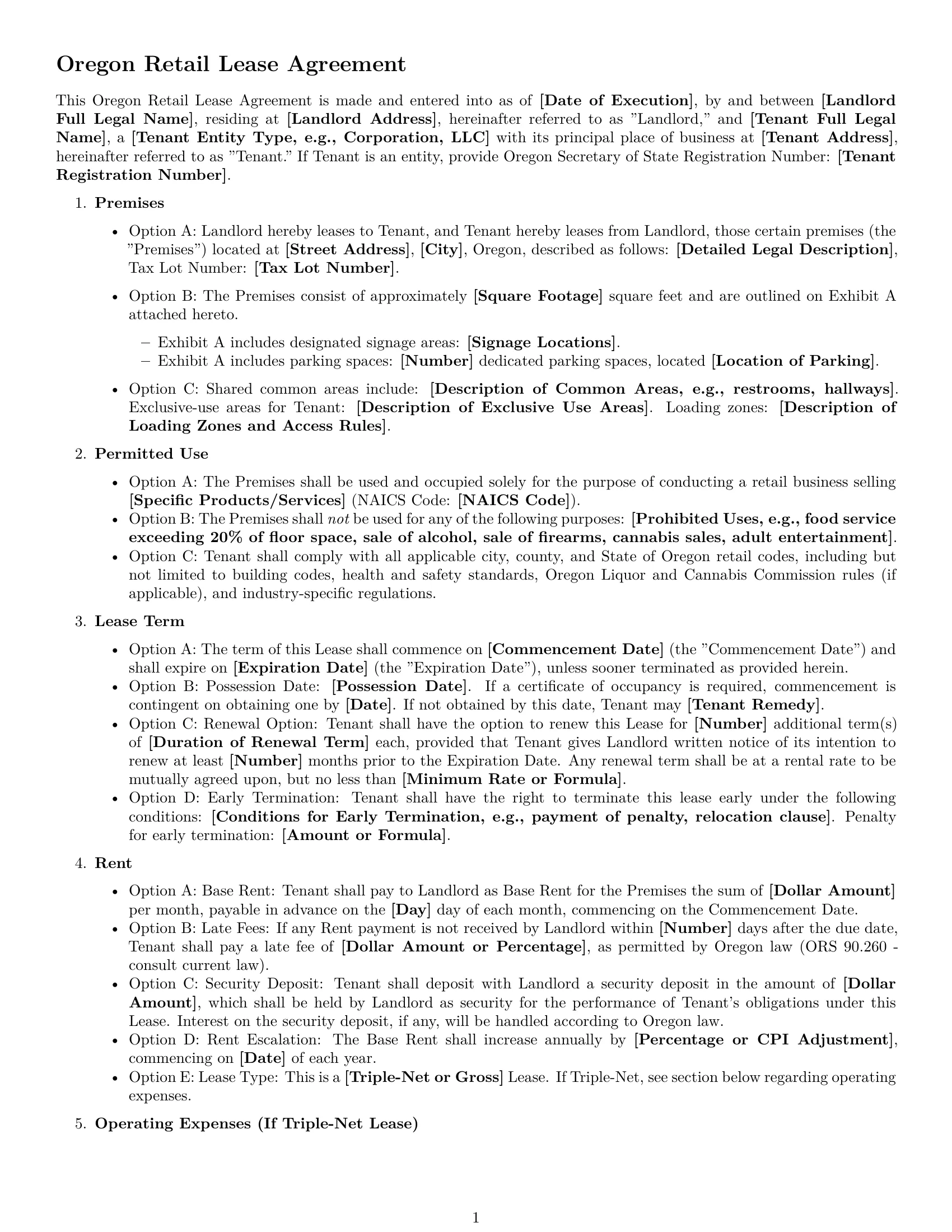

Oregon Retail Lease Agreement

This Oregon Retail Lease Agreement is made and entered into as of [Date of Execution], by and between [Landlord Full Legal Name], residing at [Landlord Address], hereinafter referred to as "Landlord," and [Tenant Full Legal Name], a [Tenant Entity Type, e.g., Corporation, LLC] with its principal place of business at [Tenant Address], hereinafter referred to as "Tenant." If Tenant is an entity, provide Oregon Secretary of State Registration Number: [Tenant Registration Number].

Premises

Option A: Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, those certain premises (the "Premises") located at [Street Address], [City], Oregon, described as follows: [Detailed Legal Description], Tax Lot Number: [Tax Lot Number].

Option B: The Premises consist of approximately [Square Footage] square feet and are outlined on Exhibit A attached hereto.

Exhibit A includes designated signage areas: [Signage Locations].

Exhibit A includes parking spaces: [Number] dedicated parking spaces, located [Location of Parking].

Option C: Shared common areas include: [Description of Common Areas, e.g., restrooms, hallways]. Exclusive-use areas for Tenant: [Description of Exclusive Use Areas]. Loading zones: [Description of Loading Zones and Access Rules].

Permitted Use

Option A: The Premises shall be used and occupied solely for the purpose of conducting a retail business selling [Specific Products/Services] (NAICS Code: [NAICS Code]).

Option B: The Premises shall not be used for any of the following purposes: [Prohibited Uses, e.g., food service exceeding 20% of floor space, sale of alcohol, sale of firearms, cannabis sales, adult entertainment].

Option C: Tenant shall comply with all applicable city, county, and State of Oregon retail codes, including but not limited to building codes, health and safety standards, Oregon Liquor and Cannabis Commission rules (if applicable), and industry-specific regulations.

Lease Term

Option A: The term of this Lease shall commence on [Commencement Date] (the "Commencement Date") and shall expire on [Expiration Date] (the "Expiration Date"), unless sooner terminated as provided herein.

Option B: Possession Date: [Possession Date]. If a certificate of occupancy is required, commencement is contingent on obtaining one by [Date]. If not obtained by this date, Tenant may [Tenant Remedy].

Option C: Renewal Option: Tenant shall have the option to renew this Lease for [Number] additional term(s) of [Duration of Renewal Term] each, provided that Tenant gives Landlord written notice of its intention to renew at least [Number] months prior to the Expiration Date. Any renewal term shall be at a rental rate to be mutually agreed upon, but no less than [Minimum Rate or Formula].

Option D: Early Termination: Tenant shall have the right to terminate this lease early under the following conditions: [Conditions for Early Termination, e.g., payment of penalty, relocation clause]. Penalty for early termination: [Amount or Formula].

Rent

Option A: Base Rent: Tenant shall pay to Landlord as Base Rent for the Premises the sum of [Dollar Amount] per month, payable in advance on the [Day] day of each month, commencing on the Commencement Date.

Option B: Late Fees: If any Rent payment is not received by Landlord within [Number] days after the due date, Tenant shall pay a late fee of [Dollar Amount or Percentage], as permitted by Oregon law (ORS 90.260 - consult current law).

Option C: Security Deposit: Tenant shall deposit with Landlord a security deposit in the amount of [Dollar Amount], which shall be held by Landlord as security for the performance of Tenant's obligations under this Lease. Interest on the security deposit, if any, will be handled according to Oregon law.

Option D: Rent Escalation: The Base Rent shall increase annually by [Percentage or CPI Adjustment], commencing on [Date] of each year.

Option E: Lease Type: This is a [Triple-Net or Gross] Lease. If Triple-Net, see section below regarding operating expenses.

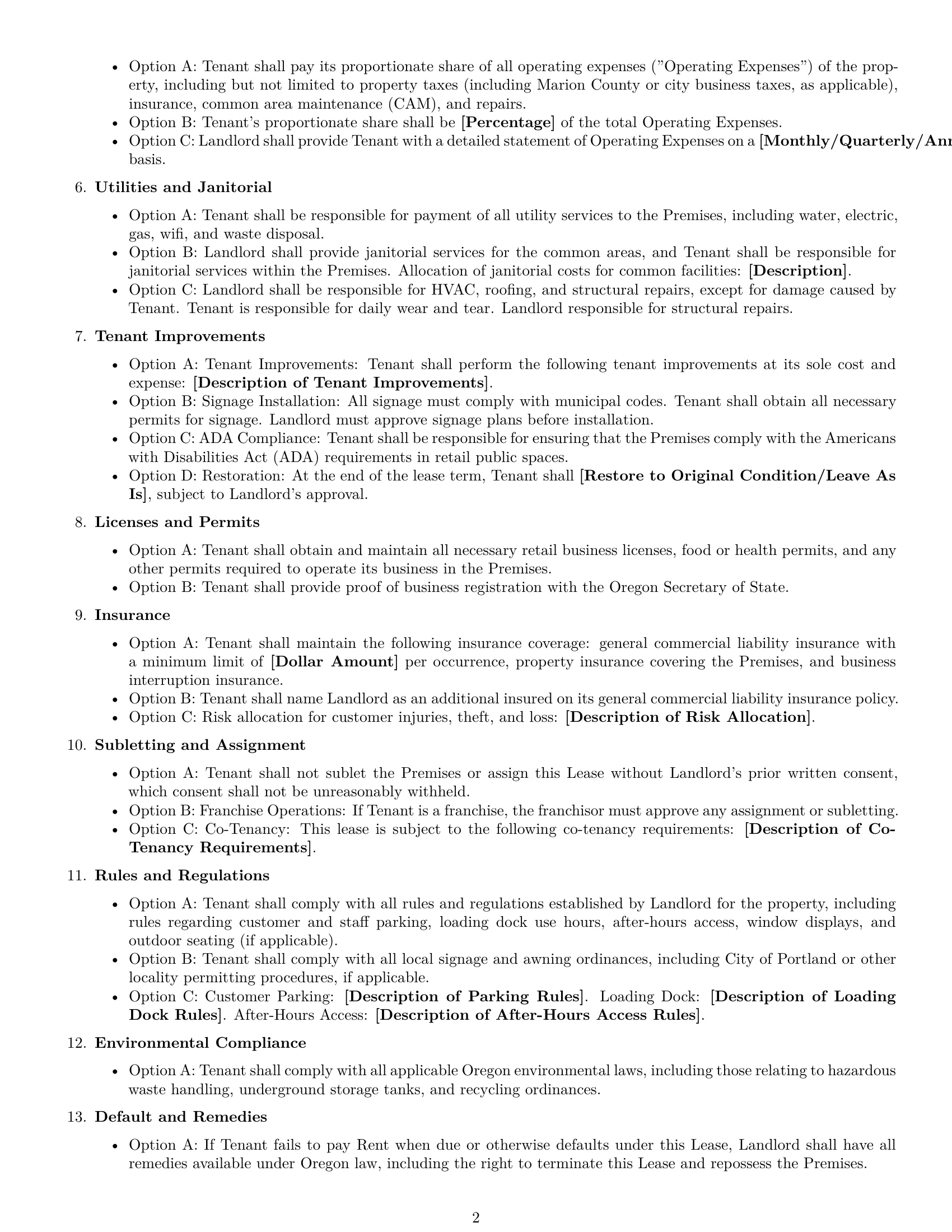

Operating Expenses (If Triple-Net Lease)

Option A: Tenant shall pay its proportionate share of all operating expenses ("Operating Expenses") of the property, including but not limited to property taxes (including Marion County or city business taxes, as applicable), insurance, common area maintenance (CAM), and repairs.

Option B: Tenant's proportionate share shall be [Percentage] of the total Operating Expenses.

Option C: Landlord shall provide Tenant with a detailed statement of Operating Expenses on a [Monthly/Quarterly/Annual] basis.

Utilities and Janitorial

Option A: Tenant shall be responsible for payment of all utility services to the Premises, including water, electric, gas, wifi, and waste disposal.

Option B: Landlord shall provide janitorial services for the common areas, and Tenant shall be responsible for janitorial services within the Premises. Allocation of janitorial costs for common facilities: [Description].

Option C: Landlord shall be responsible for HVAC, roofing, and structural repairs, except for damage caused by Tenant. Tenant is responsible for daily wear and tear. Landlord responsible for structural repairs.

Tenant Improvements

Option A: Tenant Improvements: Tenant shall perform the following tenant improvements at its sole cost and expense: [Description of Tenant Improvements].

Option B: Signage Installation: All signage must comply with municipal codes. Tenant shall obtain all necessary permits for signage. Landlord must approve signage plans before installation.

Option C: ADA Compliance: Tenant shall be responsible for ensuring that the Premises comply with the Americans with Disabilities Act (ADA) requirements in retail public spaces.

Option D: Restoration: At the end of the lease term, Tenant shall [Restore to Original Condition/Leave As Is], subject to Landlord's approval.

Licenses and Permits

Option A: Tenant shall obtain and maintain all necessary retail business licenses, food or health permits, and any other permits required to operate its business in the Premises.

Option B: Tenant shall provide proof of business registration with the Oregon Secretary of State.

Insurance

Option A: Tenant shall maintain the following insurance coverage: general commercial liability insurance with a minimum limit of [Dollar Amount] per occurrence, property insurance covering the Premises, and business interruption insurance.

Option B: Tenant shall name Landlord as an additional insured on its general commercial liability insurance policy.

Option C: Risk allocation for customer injuries, theft, and loss: [Description of Risk Allocation].

Subletting and Assignment

Option A: Tenant shall not sublet the Premises or assign this Lease without Landlord's prior written consent, which consent shall not be unreasonably withheld.

Option B: Franchise Operations: If Tenant is a franchise, the franchisor must approve any assignment or subletting.

Option C: Co-Tenancy: This lease is subject to the following co-tenancy requirements: [Description of Co-Tenancy Requirements].

Rules and Regulations

Option A: Tenant shall comply with all rules and regulations established by Landlord for the property, including rules regarding customer and staff parking, loading dock use hours, after-hours access, window displays, and outdoor seating (if applicable).

Option B: Tenant shall comply with all local signage and awning ordinances, including City of Portland or other locality permitting procedures, if applicable.

Option C: Customer Parking: [Description of Parking Rules]. Loading Dock: [Description of Loading Dock Rules]. After-Hours Access: [Description of After-Hours Access Rules].

Environmental Compliance

Option A: Tenant shall comply with all applicable Oregon environmental laws, including those relating to hazardous waste handling, underground storage tanks, and recycling ordinances.

Default and Remedies

Option A: If Tenant fails to pay Rent when due or otherwise defaults under this Lease, Landlord shall have all remedies available under Oregon law, including the right to terminate this Lease and repossess the Premises.

Option B: Notice of Default: Landlord shall provide Tenant with written notice of any default and an opportunity to cure such default within [Number] days (consistent with Oregon practice; although ORS Chapters 90 and 91 are not strictly governing commercial leases, local customs may reference similar cure rights).

Option C: Lockout Procedures: [Description of Lockout Procedures, in compliance with Oregon law].

Option D: Peaceful Surrender: Upon termination of this Lease, Tenant shall peacefully surrender the Premises to Landlord.

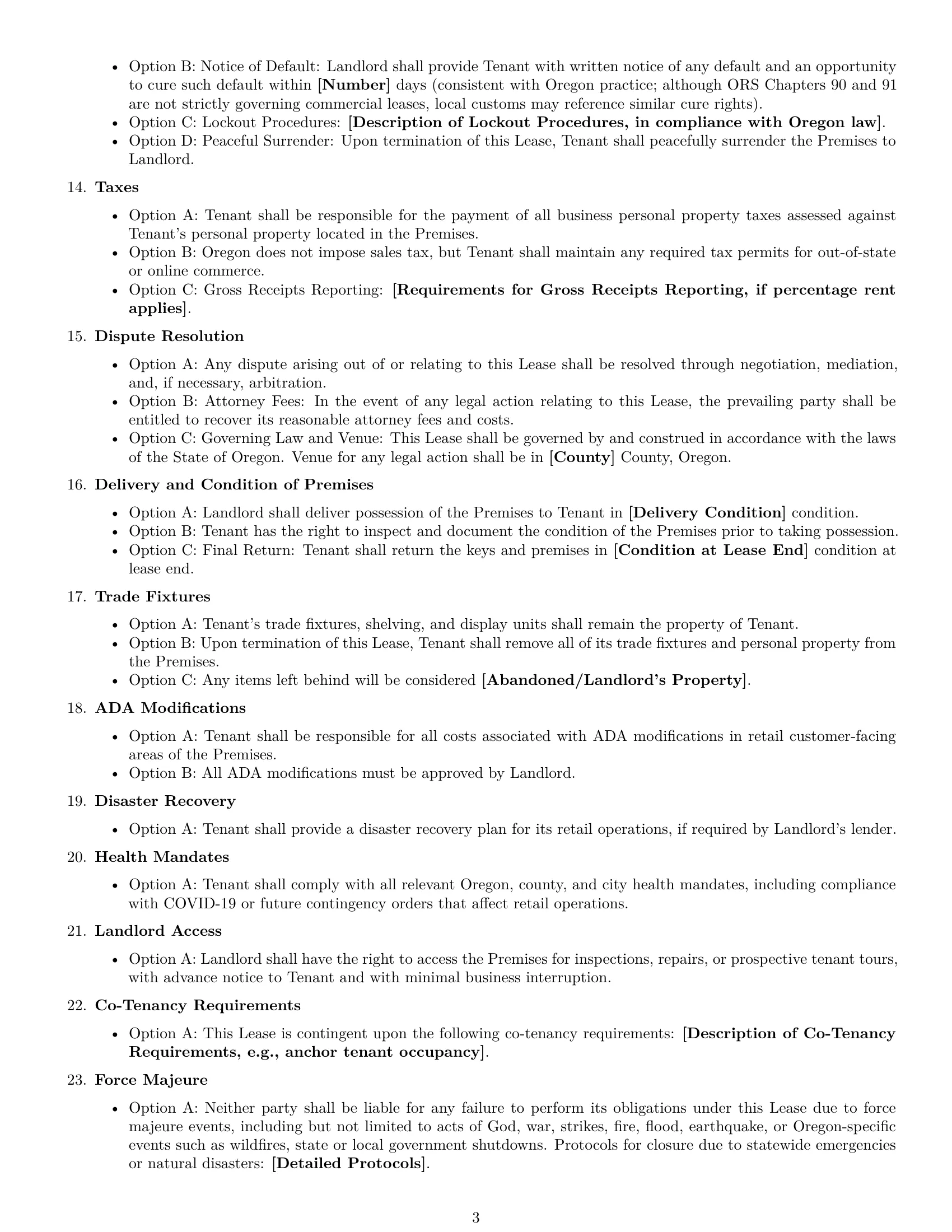

Taxes

Option A: Tenant shall be responsible for the payment of all business personal property taxes assessed against Tenant's personal property located in the Premises.

Option B: Oregon does not impose sales tax, but Tenant shall maintain any required tax permits for out-of-state or online commerce.

Option C: Gross Receipts Reporting: [Requirements for Gross Receipts Reporting, if percentage rent applies].

Dispute Resolution

Option A: Any dispute arising out of or relating to this Lease shall be resolved through negotiation, mediation, and, if necessary, arbitration.

Option B: Attorney Fees: In the event of any legal action relating to this Lease, the prevailing party shall be entitled to recover its reasonable attorney fees and costs.

Option C: Governing Law and Venue: This Lease shall be governed by and construed in accordance with the laws of the State of Oregon. Venue for any legal action shall be in [County] County, Oregon.

Delivery and Condition of Premises

Option A: Landlord shall deliver possession of the Premises to Tenant in [Delivery Condition] condition.

Option B: Tenant has the right to inspect and document the condition of the Premises prior to taking possession.

Option C: Final Return: Tenant shall return the keys and premises in [Condition at Lease End] condition at lease end.

Trade Fixtures

Option A: Tenant's trade fixtures, shelving, and display units shall remain the property of Tenant.

Option B: Upon termination of this Lease, Tenant shall remove all of its trade fixtures and personal property from the Premises.

Option C: Any items left behind will be considered [Abandoned/Landlord's Property].

ADA Modifications

Option A: Tenant shall be responsible for all costs associated with ADA modifications in retail customer-facing areas of the Premises.

Option B: All ADA modifications must be approved by Landlord.

Disaster Recovery

Option A: Tenant shall provide a disaster recovery plan for its retail operations, if required by Landlord's lender.

Health Mandates

Option A: Tenant shall comply with all relevant Oregon, county, and city health mandates, including compliance with COVID-19 or future contingency orders that affect retail operations.

Landlord Access

Option A: Landlord shall have the right to access the Premises for inspections, repairs, or prospective tenant tours, with advance notice to Tenant and with minimal business interruption.

Co-Tenancy Requirements

Option A: This Lease is contingent upon the following co-tenancy requirements: [Description of Co-Tenancy Requirements, e.g., anchor tenant occupancy].

Force Majeure

Option A: Neither party shall be liable for any failure to perform its obligations under this Lease due to force majeure events, including but not limited to acts of God, war, strikes, fire, flood, earthquake, or Oregon-specific events such as wildfires, state or local government shutdowns. Protocols for closure due to statewide emergencies or natural disasters: [Detailed Protocols].

Notice

Option A: All notices under this Lease shall be in writing and delivered by registered mail or electronic means (per Oregon law) to the addresses set forth above.

Memorandum of Lease

Option A: [Landlord/Tenant] shall be responsible for recording a Memorandum of Lease, if relevant.

IN WITNESS WHEREOF, the parties have executed this Oregon Retail Lease Agreement as of the date first written above.

____________________________

[Landlord Full Legal Name]

____________________________

[Tenant Full Legal Name]