Minnesota partnership agreement template

View and compare the Free version and the Pro version.

Help Center

Need to learn how to convert downloaded contract DOCX files to PDF or add electronic signatures? Please visit our Help Center for detailed guidance.

How Minnesota partnership agreement Differ from Other States

-

Minnesota requires the filing of a Certificate of Assumed Name when operating under a name different from the partners’ legal names, which is not mandatory in all states.

-

Minnesota statutes set clear default rules on profit and loss sharing, which may differ from the Uniform Partnership Act or specific state adaptations.

-

Minnesota has explicit statutory provisions for dissociation and dissolution of partnerships, detailing required steps more thoroughly than many other states.

Frequently Asked Questions (FAQ)

-

Q: Is a written partnership agreement required in Minnesota?

A: No, Minnesota law does not require a written partnership agreement, but having one is strongly recommended to avoid disputes.

-

Q: Do I need to register my partnership in Minnesota?

A: Registration is required only if you do business under an assumed name; otherwise, no formal filing is necessary for a general partnership.

-

Q: Are partnership profits in Minnesota taxed at the entity level?

A: No, Minnesota partnerships are generally not taxed at the entity level. Profits and losses pass through to the individual partners.

HTML Code Preview

Minnesota Partnership Agreement

This Partnership Agreement is made and entered into as of this [Date] day of [Month], [Year], by and among the following individuals (hereinafter collectively referred to as "Partners" and individually as "Partner"):

- [Partner 1 Name], residing at [Partner 1 Address]

- [Partner 2 Name], residing at [Partner 2 Address]

- [Partner 3 Name], residing at [Partner 3 Address] (Add more partners as needed)

The Partners agree to form a partnership (hereinafter referred to as the "Partnership") under the laws of the State of Minnesota.

The Partnership shall be known as [Partnership Name], with its principal place of business located at [Partnership Address].

The purpose of the Partnership is [Partnership Purpose/Business Description].

- Option A: The Partnership's purpose is limited to: [Specific Limited Purpose].

- Option B: The Partnership is expressly prohibited from engaging in the following activities: [List of Prohibited Activities].

This Agreement shall become effective as of [Effective Date].

The term of the Partnership shall be:

- Option A: For a fixed term of [Number] years, commencing on the Effective Date, unless sooner terminated as provided herein. The Partnership shall terminate on [Termination Date].

- Option B: For an indefinite term, commencing on the Effective Date.

- Option C: For a term of [Number] years, automatically renewing for successive [Number] year terms unless written notice of termination is given by any Partner at least [Number] days prior to the end of the then-current term.

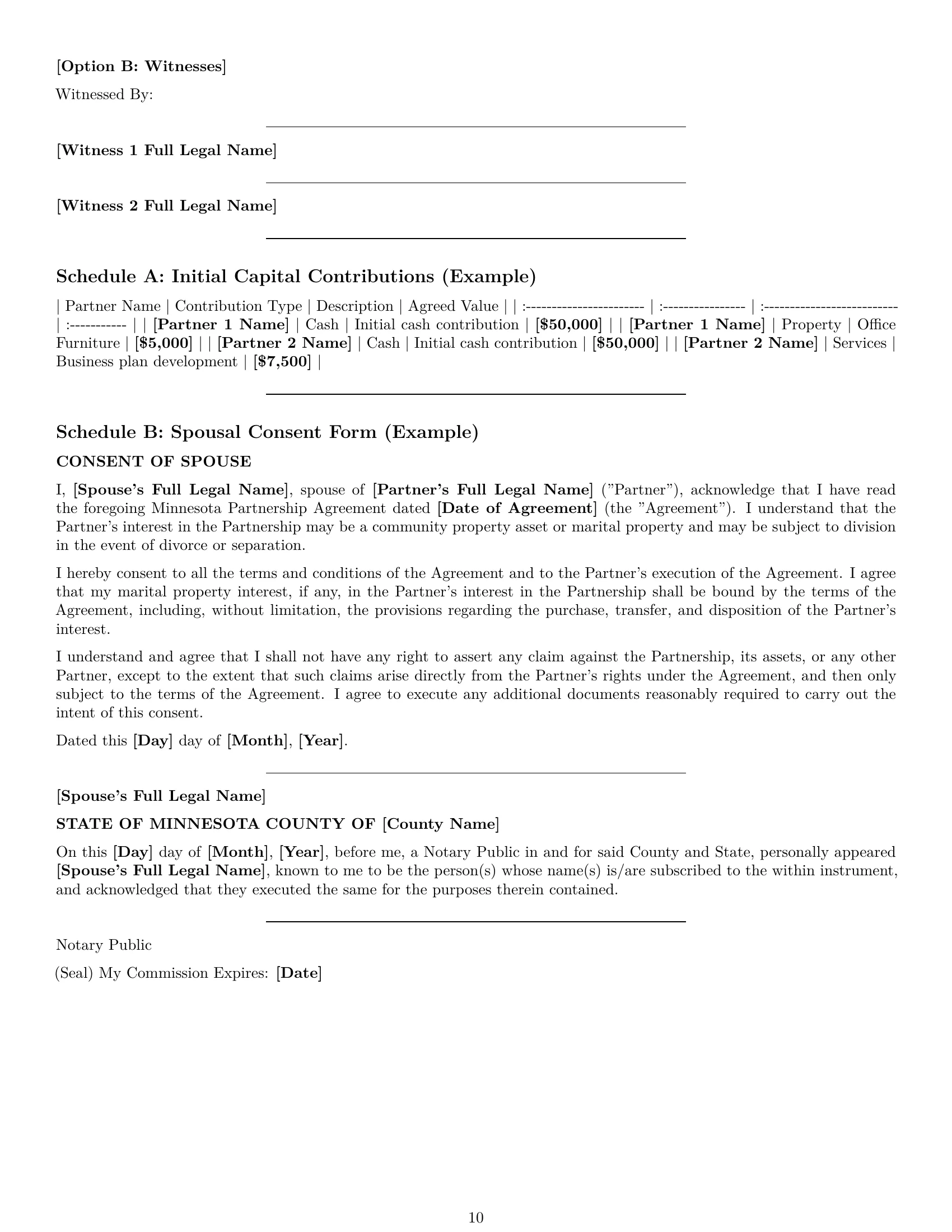

Each Partner shall contribute to the capital of the Partnership as follows:

- [Partner 1 Name]: [Contribution Description, e.g., $X in cash, property described in Exhibit A valued at $Y]. Valuation Method: [Valuation Method, e.g., Fair Market Value, Agreed Upon Value].

- [Partner 2 Name]: [Contribution Description, e.g., Services valued at $Z, property described in Exhibit B valued at $W]. Valuation Method: [Valuation Method, e.g., Fair Market Value, Agreed Upon Value].

- [Partner 3 Name]: [Contribution Description]. Valuation Method: [Valuation Method].

The initial capital contributions of the Partners shall result in the following ownership percentages:

- [Partner 1 Name]: [Percentage]%

- [Partner 2 Name]: [Percentage]%

- [Partner 3 Name]: [Percentage]%

Additional Capital Contributions:

- Option A: No Partner shall be required to make any additional capital contributions to the Partnership.

- Option B: If the Partners unanimously agree that additional capital is required, each Partner shall contribute in proportion to their ownership percentage.

- Option C: Capital calls may be made by a vote of [Percentage]% of the Partners.

- If a Partner fails to contribute their share of a capital call, the other Partners shall have the option to:

- Option 1: Loan the defaulting Partner the necessary funds at an interest rate of [Percentage]%.

- Option 2: Reduce the defaulting Partner's ownership percentage in proportion to the unpaid contribution.

- Option 3: Purchase the defaulting Partner's partnership interest at a price determined by [Method of Determination, e.g., appraisal, formula].

- If a Partner fails to contribute their share of a capital call, the other Partners shall have the option to:

The net profits and net losses of the Partnership shall be allocated among the Partners in proportion to their ownership percentages as set forth above.

Distributions of profits shall be made to the Partners:

- Option A: Annually, within [Number] days after the end of each fiscal year.

- Option B: Quarterly, within [Number] days after the end of each quarter.

- Option C: At such times and in such amounts as the Partners may unanimously agree.

- Option D: Subject to the discretion of the Managing Partner (see below).

- Option E: Partner draws are allowed up to [Dollar Amount] per [Time Period].

Taxation: The Partnership intends to be taxed as a partnership for federal and state income tax purposes, with each Partner reporting their share of Partnership income, deductions, gains, and losses on their individual income tax returns.

Each Partner shall have the right to participate in the management and control of the Partnership.

Voting Rights:

- Option A: Each Partner shall have one vote for each percentage point of ownership they hold in the Partnership.

- Option B: All decisions shall be made by unanimous consent of the Partners.

- Option C: Routine decisions may be made by a majority vote of the Partners. Extraordinary decisions require unanimous consent. Extraordinary decisions are defined as: [Definition of Extraordinary Decisions].

Management Structure:

- Option A: The Partnership shall be managed by all of the Partners.

- Option B: [Partner Name] shall be the Managing Partner. The Managing Partner shall have the authority to: [List of Authorities].

- Option C: A management committee consisting of [Number] Partners shall be formed. The members of the management committee are: [List of Names].

Partner Duties and Obligations:

- Each Partner shall devote [Number] hours per week to the Partnership's business.

- [Partner Name] shall be responsible for [List of Responsibilities].

- [Partner Name] shall be responsible for [List of Responsibilities].

- Non-Compete: During the term of this Agreement and for a period of [Number] years following the termination of a Partner's interest in the Partnership, no Partner shall engage in any business that competes with the Partnership within a [Number] mile radius of the Partnership's principal place of business, subject to Minnesota law regarding enforceability.

- Confidentiality: Each partner agrees to keep all partnership information strictly confidential.

Admission of New Partners:

- A new partner may be admitted to the Partnership only upon the unanimous consent of all existing Partners.

- A new Partner shall contribute to the capital of the Partnership in an amount to be determined by the existing Partners.

Voluntary Withdrawal:

- A Partner may voluntarily withdraw from the Partnership upon [Number] days written notice to the other Partners.

- Upon withdrawal, the withdrawing Partner shall be entitled to receive the value of their Partnership interest, as determined by [Method of Determination, e.g., appraisal, formula]. Payment shall be made within [Number] days of the effective date of withdrawal.

Involuntary Withdrawal/Expulsion:

- A Partner may be involuntarily expelled from the Partnership for [List of Reasons, e.g., breach of this Agreement, gross misconduct].

- Expulsion requires a vote of [Percentage]% of the Partners, excluding the Partner being considered for expulsion.

- Upon expulsion, the expelled Partner shall be entitled to receive the value of their Partnership interest, as determined by [Method of Determination, e.g., appraisal, formula].

Transfer of Partnership Interest:

- No Partner may transfer their Partnership interest without the unanimous consent of the other Partners.

- Right of First Refusal: If a Partner desires to transfer their Partnership interest, the other Partners shall have the right of first refusal to purchase the interest at a price and on terms to be determined by [Method of Determination, e.g., appraisal, formula].

Dissolution:

- The Partnership shall dissolve upon the occurrence of any of the following events:

- Unanimous agreement of the Partners.

- Expiration of the Partnership's term (if applicable).

- Bankruptcy of a Partner.

- Death of a Partner (unless the remaining Partners elect to continue the Partnership).

- Court order.

Winding Up:

- Upon dissolution, the assets of the Partnership shall be liquidated. The proceeds of liquidation shall be distributed in the following order:

- Payment of debts and liabilities of the Partnership.

- Repayment of loans made by Partners to the Partnership.

- Distribution to the Partners in proportion to their ownership percentages.

Continuation:

- Option A: Upon the death or withdrawal of a Partner, the Partnership shall automatically dissolve.

- Option B: Upon the death or withdrawal of a Partner, the remaining Partners may elect to continue the Partnership upon [Percentage]% vote.

Indemnification:

The Partnership shall indemnify each Partner against any loss, damage, or liability incurred by the Partner in connection with the Partnership's business, except for losses, damages, or liabilities resulting from the Partner's gross negligence or willful misconduct.

Dispute Resolution:

- Any dispute arising out of or relating to this Agreement shall be resolved through:

- Option A: Negotiation.

- Option B: Mediation.

- Option C: Arbitration in [City, State], in accordance with the rules of the American Arbitration Association.

- Option D: Litigation in the state courts of Minnesota, County of [County Name].

Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of Minnesota, including the Minnesota Uniform Partnership Act.

Confidentiality: Each Partner acknowledges that they will have access to confidential information of the Partnership. Each Partner agrees to hold such information in confidence and not to disclose it to any third party without the prior written consent of the other Partners.

Banking:

- The Partnership shall maintain a bank account at [Bank Name], located at [Bank Address].

- The authorized signatories for the Partnership's bank account shall be [Partner Names].

Insurance:

- The Partnership shall maintain general liability insurance in an amount of not less than [Dollar Amount].

- Key Person Insurance: The Partnership shall maintain key person life insurance on [Partner Name(s)] in the amount of [Dollar Amount].

- The responsibility for obtaining and paying for insurance shall be that of [Partner Name].

Tax Matters:

- The tax representative of the Partnership shall be [Partner Name].

- The Partnership's fiscal year shall end on [Date].

Amendment: This Agreement may be amended only by a written instrument signed by all of the Partners.

Severability: If any provision of this Agreement is held to be invalid or unenforceable, the remaining provisions shall remain in full force and effect.

Spousal Consent (If Applicable): [Partner Name]'s spouse, [Spouse Name], consents to the terms of this Agreement and acknowledges that their marital property interests may be affected.

Counterparts: This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

____________________________ [Partner 1 Name]

____________________________ [Partner 2 Name]

____________________________ [Partner 3 Name] (Add more partners as needed)