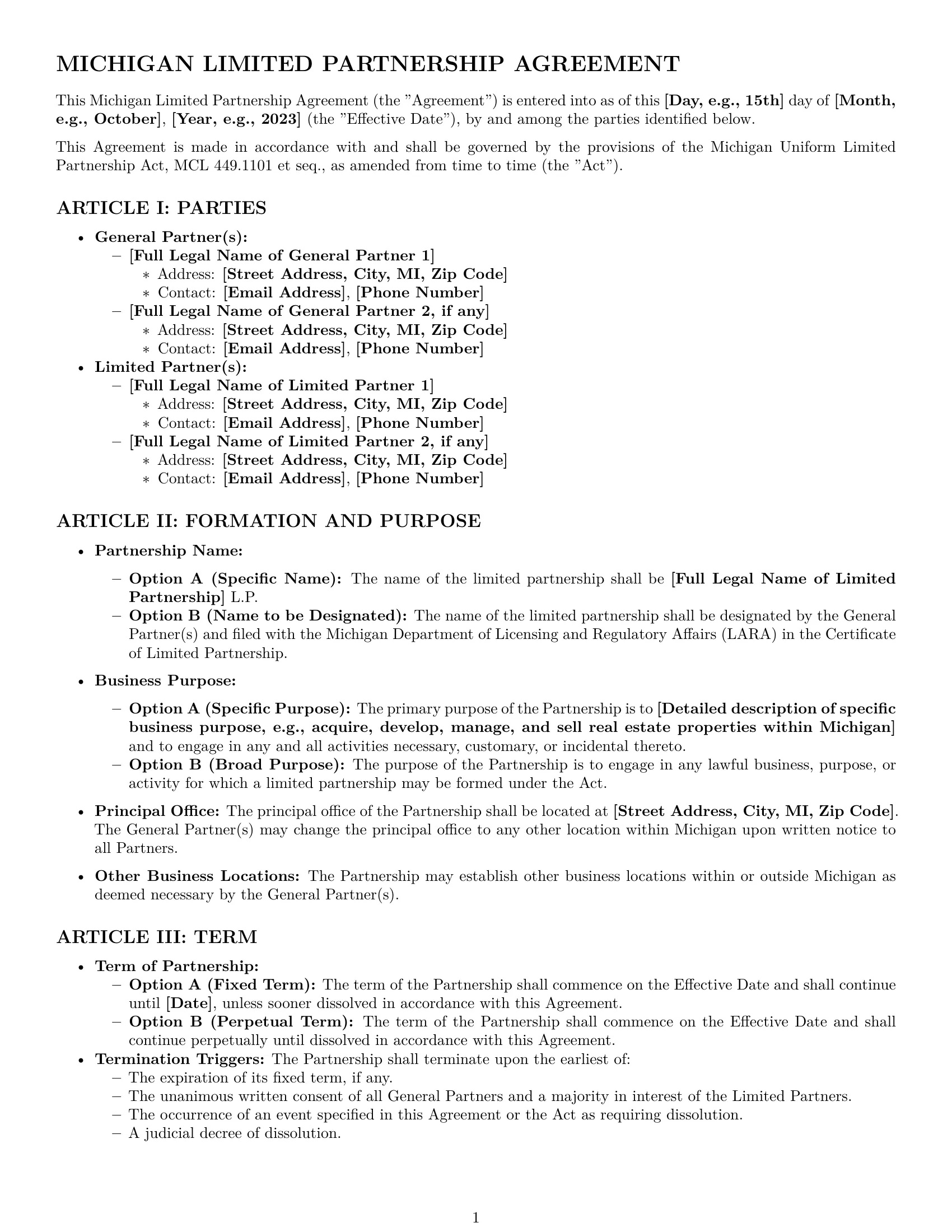

Michigan limited partnership agreement template

View and compare the Free version and the Pro version.

Help Center

Need to learn how to convert downloaded contract DOCX files to PDF or add electronic signatures? Please visit our Help Center for detailed guidance.

How Michigan limited partnership agreement Differ from Other States

-

Michigan requires registration under the Michigan Uniform Limited Partnership Act, with specific filing protocols that may differ from other states.

-

Michigan mandates the inclusion of certain management and voting rights provisions, unique to its statutory requirements.

-

Annual report and tax requirements for Michigan limited partnerships are distinct and must comply specifically with Michigan law.

Frequently Asked Questions (FAQ)

-

Q: Is registration with the state mandatory for a Michigan limited partnership?

A: Yes. Michigan law requires all limited partnerships to file a Certificate of Limited Partnership with the state.

-

Q: Are there annual reporting requirements for Michigan limited partnerships?

A: Yes, Michigan limited partnerships must file an annual statement with the Department of Licensing and Regulatory Affairs.

-

Q: Can a limited partner actively manage the partnership in Michigan?

A: No. In Michigan, limited partners cannot manage or control the business without risking loss of limited liability status.

HTML Code Preview

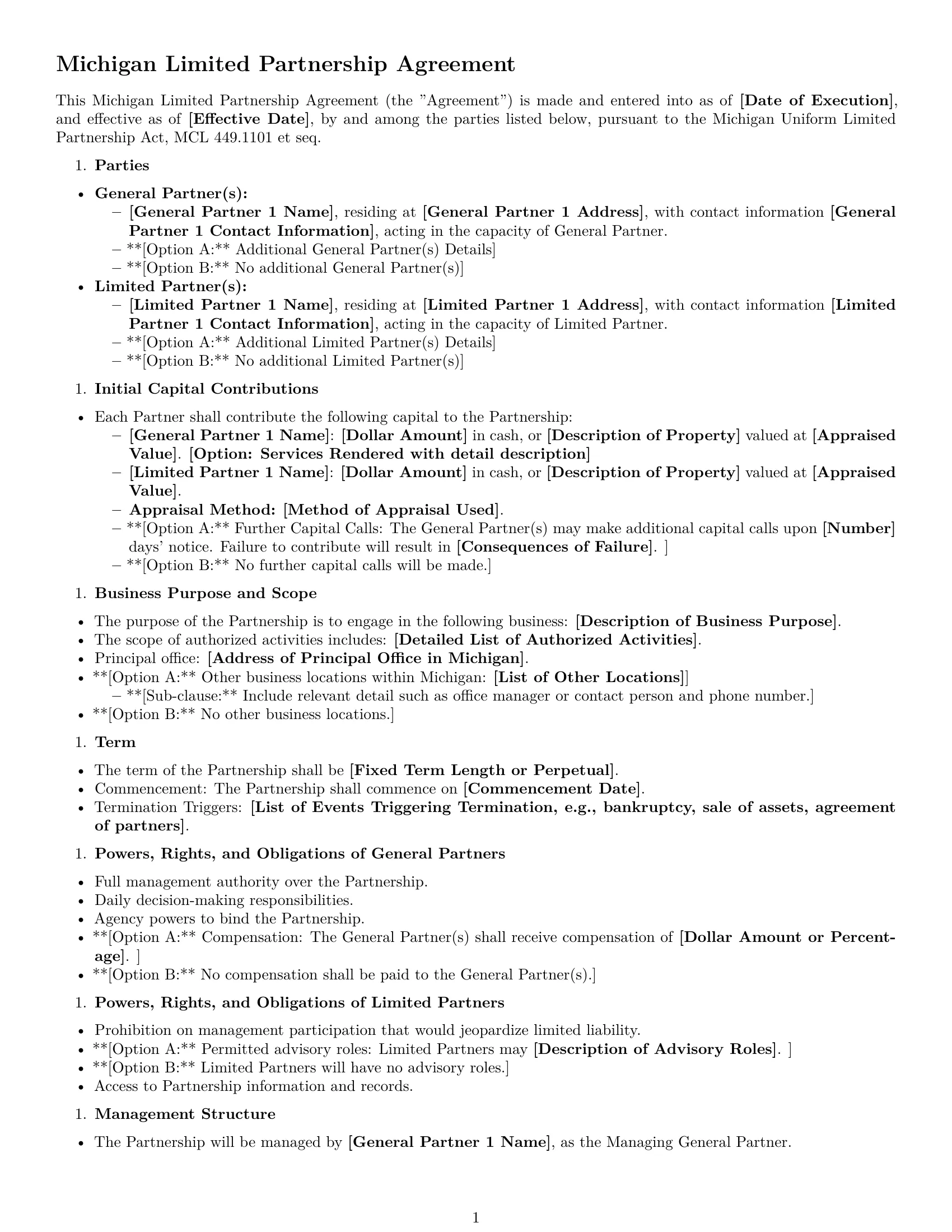

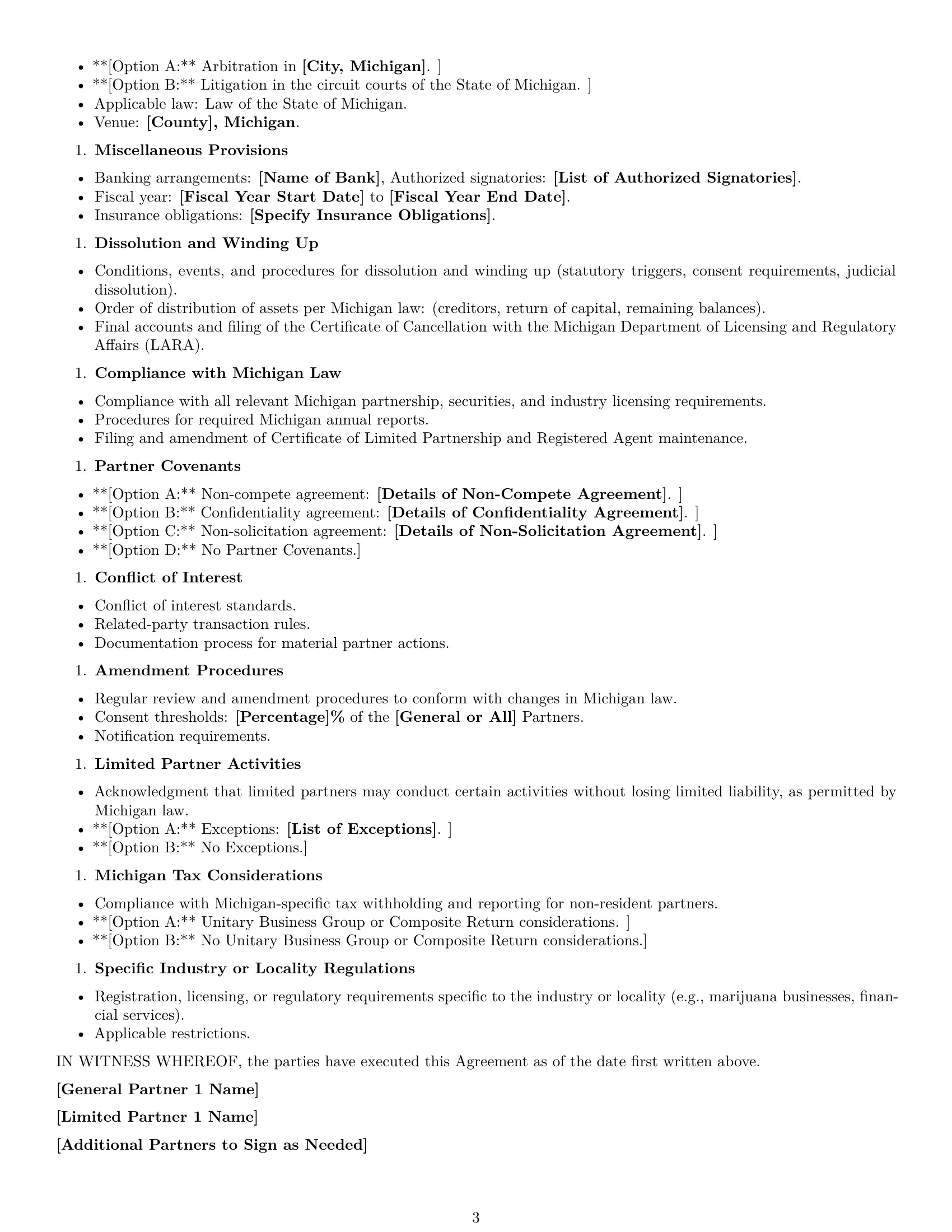

Michigan Limited Partnership Agreement

This Michigan Limited Partnership Agreement (the "Agreement") is made and entered into as of [Date of Execution], and effective as of [Effective Date], by and among the parties listed below, pursuant to the Michigan Uniform Limited Partnership Act, MCL 449.1101 et seq.

Parties

- General Partner(s):

- [General Partner 1 Name], residing at [General Partner 1 Address], with contact information [General Partner 1 Contact Information], acting in the capacity of General Partner.

- [Option A: Additional General Partner(s) Details]

- [Option B: No additional General Partner(s)]

- Limited Partner(s):

- [Limited Partner 1 Name], residing at [Limited Partner 1 Address], with contact information [Limited Partner 1 Contact Information], acting in the capacity of Limited Partner.

- [Option A: Additional Limited Partner(s) Details]

- [Option B: No additional Limited Partner(s)]

Initial Capital Contributions

- Each Partner shall contribute the following capital to the Partnership:

- [General Partner 1 Name]: [Dollar Amount] in cash, or [Description of Property] valued at [Appraised Value]. [Option: Services Rendered with detail description]

- [Limited Partner 1 Name]: [Dollar Amount] in cash, or [Description of Property] valued at [Appraised Value].

- Appraisal Method: [Method of Appraisal Used].

- [Option A: Further Capital Calls: The General Partner(s) may make additional capital calls upon [Number] days' notice. Failure to contribute will result in [Consequences of Failure]].

- [Option B: No further capital calls will be made.]

Business Purpose and Scope

- The purpose of the Partnership is to engage in the following business: [Description of Business Purpose].

- The scope of authorized activities includes: [Detailed List of Authorized Activities].

- Principal office: [Address of Principal Office in Michigan].

- [Option A: Other business locations within Michigan: [List of Other Locations]]

- [Sub-clause: Include relevant detail such as office manager or contact person and phone number.]

- [Option B: No other business locations.]

Term

- The term of the Partnership shall be [Fixed Term Length or Perpetual].

- Commencement: The Partnership shall commence on [Commencement Date].

- Termination Triggers: [List of Events Triggering Termination, e.g., bankruptcy, sale of assets, agreement of partners].

Powers, Rights, and Obligations of General Partners

- Full management authority over the Partnership.

- Daily decision-making responsibilities.

- Agency powers to bind the Partnership.

- [Option A: Compensation: The General Partner(s) shall receive compensation of [Dollar Amount or Percentage].]

- [Option B: No compensation shall be paid to the General Partner(s).]

Powers, Rights, and Obligations of Limited Partners

- Prohibition on management participation that would jeopardize limited liability.

- [Option A: Permitted advisory roles: Limited Partners may [Description of Advisory Roles].]

- [Option B: Limited Partners will have no advisory roles.]

- Access to Partnership information and records.

Management Structure

- The Partnership will be managed by [General Partner 1 Name], as the Managing General Partner.

- [Option A: Appointment and Removal: The Managing General Partner may be removed by [Percentage]% vote of the General Partners.]

- [Option B: No removal of Managing General Partner unless they voluntarily remove themselves.]

- Duties of the Managing General Partner: [List of Duties].

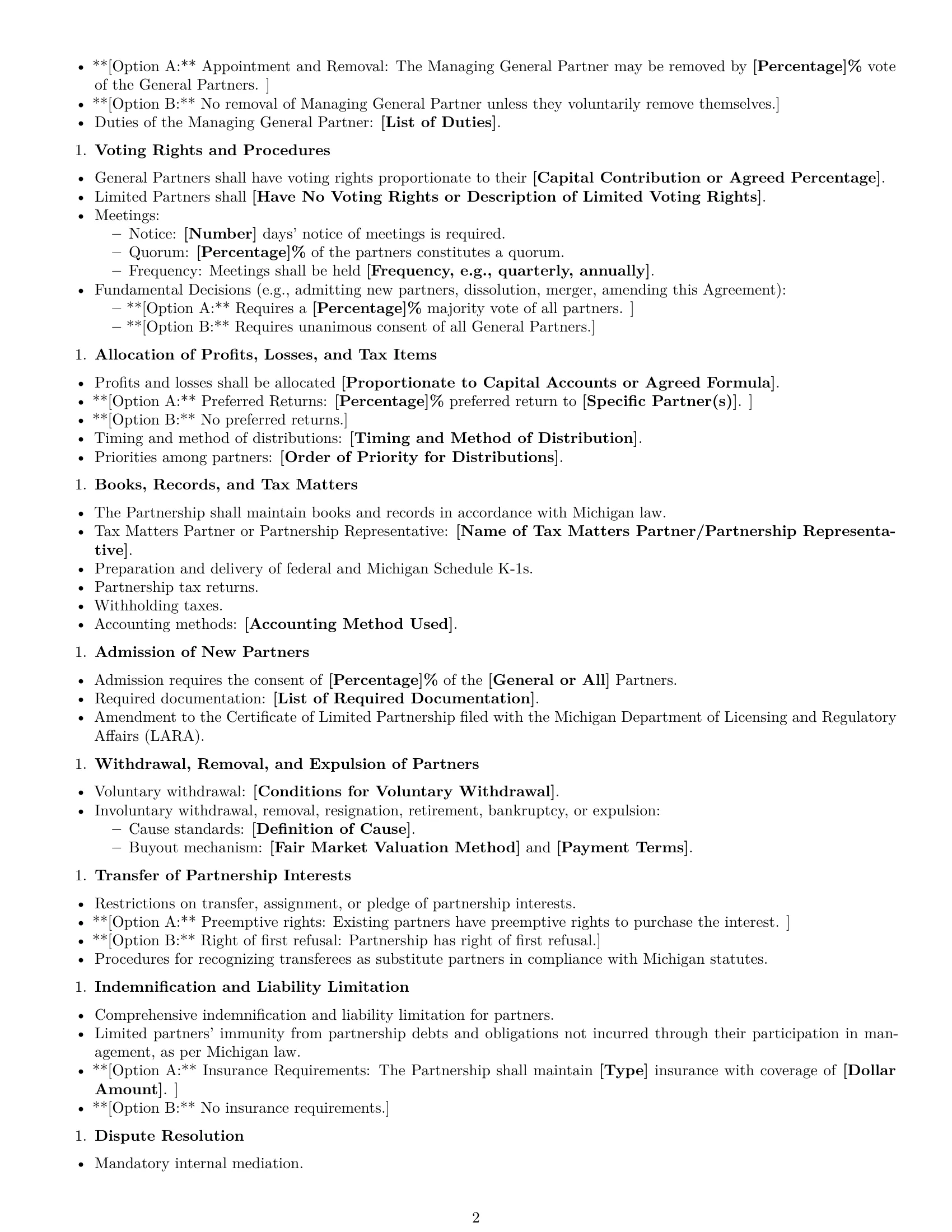

Voting Rights and Procedures

- General Partners shall have voting rights proportionate to their [Capital Contribution or Agreed Percentage].

- Limited Partners shall [Have No Voting Rights or Description of Limited Voting Rights].

- Meetings:

- Notice: [Number] days' notice of meetings is required.

- Quorum: [Percentage]% of the partners constitutes a quorum.

- Frequency: Meetings shall be held [Frequency, e.g., quarterly, annually].

- Fundamental Decisions (e.g., admitting new partners, dissolution, merger, amending this Agreement):

- [Option A: Requires a [Percentage]% majority vote of all partners.]

- [Option B: Requires unanimous consent of all General Partners.]

Allocation of Profits, Losses, and Tax Items

- Profits and losses shall be allocated [Proportionate to Capital Accounts or Agreed Formula].

- [Option A: Preferred Returns: [Percentage]% preferred return to [Specific Partner(s)].]

- [Option B: No preferred returns.]

- Timing and method of distributions: [Timing and Method of Distribution].

- Priorities among partners: [Order of Priority for Distributions].

Books, Records, and Tax Matters

- The Partnership shall maintain books and records in accordance with Michigan law.

- Tax Matters Partner or Partnership Representative: [Name of Tax Matters Partner/Partnership Representative].

- Preparation and delivery of federal and Michigan Schedule K-1s.

- Partnership tax returns.

- Withholding taxes.

- Accounting methods: [Accounting Method Used].

Admission of New Partners

- Admission requires the consent of [Percentage]% of the [General or All] Partners.

- Required documentation: [List of Required Documentation].

- Amendment to the Certificate of Limited Partnership filed with the Michigan Department of Licensing and Regulatory Affairs (LARA).

Withdrawal, Removal, and Expulsion of Partners

- Voluntary withdrawal: [Conditions for Voluntary Withdrawal].

- Involuntary withdrawal, removal, resignation, retirement, bankruptcy, or expulsion:

- Cause standards: [Definition of Cause].

- Buyout mechanism: [Fair Market Valuation Method] and [Payment Terms].

Transfer of Partnership Interests

- Restrictions on transfer, assignment, or pledge of partnership interests.

- [Option A: Preemptive rights: Existing partners have preemptive rights to purchase the interest.]

- [Option B: Right of first refusal: Partnership has right of first refusal.]

- Procedures for recognizing transferees as substitute partners in compliance with Michigan statutes.

Indemnification and Liability Limitation

- Comprehensive indemnification and liability limitation for partners.

- Limited partners' immunity from partnership debts and obligations not incurred through their participation in management, as per Michigan law.

- [Option A: Insurance Requirements: The Partnership shall maintain [Type] insurance with coverage of [Dollar Amount].]

- [Option B: No insurance requirements.]

Dispute Resolution

- Mandatory internal mediation.

- [Option A: Arbitration in [City, Michigan].]

- [Option B: Litigation in the circuit courts of the State of Michigan.]

- Applicable law: Law of the State of Michigan.

- Venue: [County], Michigan.

Miscellaneous Provisions

- Banking arrangements: [Name of Bank], Authorized signatories: [List of Authorized Signatories].

- Fiscal year: [Fiscal Year Start Date] to [Fiscal Year End Date].

- Insurance obligations: [Specify Insurance Obligations].

Dissolution and Winding Up

- Conditions, events, and procedures for dissolution and winding up (statutory triggers, consent requirements, judicial dissolution).

- Order of distribution of assets per Michigan law: (creditors, return of capital, remaining balances).

- Final accounts and filing of the Certificate of Cancellation with the Michigan Department of Licensing and Regulatory Affairs (LARA).

Compliance with Michigan Law

- Compliance with all relevant Michigan partnership, securities, and industry licensing requirements.

- Procedures for required Michigan annual reports.

- Filing and amendment of Certificate of Limited Partnership and Registered Agent maintenance.

Partner Covenants

- [Option A: Non-compete agreement: [Details of Non-Compete Agreement].]

- [Option B: Confidentiality agreement: [Details of Confidentiality Agreement].]

- [Option C: Non-solicitation agreement: [Details of Non-Solicitation Agreement].]

- [Option D: No Partner Covenants.]

Conflict of Interest

- Conflict of interest standards.

- Related-party transaction rules.

- Documentation process for material partner actions.

Amendment Procedures

- Regular review and amendment procedures to conform with changes in Michigan law.

- Consent thresholds: [Percentage]% of the [General or All] Partners.

- Notification requirements.

Limited Partner Activities

- Acknowledgment that limited partners may conduct certain activities without losing limited liability, as permitted by Michigan law.

- [Option A: Exceptions: [List of Exceptions].]

- [Option B: No Exceptions.]

Michigan Tax Considerations

- Compliance with Michigan-specific tax withholding and reporting for non-resident partners.

- [Option A: Unitary Business Group or Composite Return considerations.]

- [Option B: No Unitary Business Group or Composite Return considerations.]

Specific Industry or Locality Regulations

- Registration, licensing, or regulatory requirements specific to the industry or locality (e.g., marijuana businesses, financial services).

- Applicable restrictions.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

[General Partner 1 Name]

[Limited Partner 1 Name]

[Additional Partners to Sign as Needed]