Kansas partnership agreement template

View and compare the Free version and the Pro version.

Help Center

Need to learn how to convert downloaded contract DOCX files to PDF or add electronic signatures? Please visit our Help Center for detailed guidance.

How Kansas partnership agreement Differ from Other States

-

Kansas recognizes oral partnership agreements as legally binding, while some states require written agreements for enforceability.

-

Kansas follows the Kansas Uniform Partnership Act, which may have unique dissolution and liability provisions compared to other states.

-

Partners in Kansas are individually liable for partnership debts, but Kansas law allows for easy conversion to limited liability entities.

Frequently Asked Questions (FAQ)

-

Q: Is a written partnership agreement required in Kansas?

A: No, Kansas recognizes both oral and written partnership agreements, but having one in writing is highly recommended.

-

Q: Does a Kansas partnership agreement need to be notarized?

A: Notarization is not required for validity but may provide extra proof of authenticity if the agreement is ever challenged.

-

Q: Are partnership agreements filed with the state in Kansas?

A: No, Kansas does not require general partnership agreements to be filed with the state; they are kept between the partners.

HTML Code Preview

Kansas Partnership Agreement

This KANSAS PARTNERSHIP AGREEMENT (the “Agreement”) is made and effective as of this [Date of Signing], by and among:

- [Partner 1 Name], residing at [Partner 1 Address], hereinafter referred to as “Partner 1”;

- [Partner 2 Name], residing at [Partner 2 Address], hereinafter referred to as “Partner 2”;

- [Partner 3 Name], residing at [Partner 3 Address], hereinafter referred to as “Partner 3”;

(Add additional partners as needed)

The Partners desire to associate themselves as partners in a partnership.

Therefore, in consideration of the mutual covenants contained herein, the parties agree as follows:

Formation and Name

- Option A: The parties hereby form a general partnership under the laws of the State of Kansas.

- Option B: The parties hereby form a limited partnership under the laws of the State of Kansas, and shall execute and file a Certificate of Limited Partnership with the Kansas Secretary of State.

- Option C: The parties hereby form a limited liability partnership under the laws of the State of Kansas, and shall register as such with the Kansas Secretary of State.

The name of the partnership shall be [Partnership Name], and may also do business as [DBA Name, if applicable].

Principal Place of Business

- The principal place of business of the Partnership shall be located at [Partnership Address].

- Other operational locations may be established as needed with the consent of [Specify Consent Requirement, e.g., majority of partners].

Purpose

- The purpose of the Partnership is to engage in the following business activities: [Description of Business Activities].

- Option A: The Partnership's business activities shall be limited to the activities specifically described above.

- Option B: The Partnership may engage in any lawful business activity, as determined by [Specify Decision-Making Process, e.g., majority vote of the partners].

- Option C: The Partnership shall not engage in the following business activities: [List of Excluded Activities].

Term

- Option A: The term of this Partnership shall commence on [Commencement Date] and shall continue until terminated as provided herein.

- Option B: The term of this Partnership shall commence on [Commencement Date] and shall continue for a fixed term of [Number] years, expiring on [Expiration Date].

- Option C: The term of this Partnership shall commence on [Commencement Date] and shall continue until the completion of [Specific Project].

Capital Contributions

- Each Partner shall contribute to the capital of the Partnership the following:

- [Partner 1 Name]: [Amount] in [Type of Contribution, e.g., cash, property], to be contributed [Schedule of Contribution].

- [Partner 2 Name]: [Amount] in [Type of Contribution, e.g., cash, property], to be contributed [Schedule of Contribution].

- [Partner 3 Name]: [Amount] in [Type of Contribution, e.g., cash, property], to be contributed [Schedule of Contribution].

- Option A: No Partner shall be required to make any additional capital contributions.

- Option B: Additional capital contributions may be requested from the Partners if deemed necessary by [Specify Decision-Making Process, e.g., majority vote of the partners]. Such contributions shall be made in proportion to their respective percentage interests in the Partnership.

- Option C: Additional capital contributions are mandatory if the Partnership incurs losses exceeding its capital, with each partner contributing in proportion to their ownership percentage. Failure to contribute will result in [Specify Consequence, e.g., dilution of ownership percentage].

Upon dissolution of the partnership, capital contributions shall be returned to each partner after all liabilities are settled, proportionate to their initial contribution less any previous withdrawals or distributions of capital.

Ownership, Profits, Losses, and Distributions

- The initial percentage interests of the Partners in the Partnership shall be as follows:

- [Partner 1 Name]: [Percentage]%

- [Partner 2 Name]: [Percentage]%

- [Partner 3 Name]: [Percentage]%

- Option A: Profits and losses shall be allocated among the Partners in proportion to their respective percentage interests.

- Option B: Profits and losses shall be allocated equally among the Partners.

- Option C: Profits and losses shall be allocated as follows: [Specific Allocation Method].

Distributions of Partnership profits shall be made [Distribution Schedule, e.g., quarterly, annually].

- Option A: The Partnership shall retain a portion of its earnings as retained earnings for future needs, as determined by [Specify Decision-Making Process].

- Option B: All profits shall be distributed to the partners, less amounts needed for reasonable operating expenses.

- Option C: [Partner Name] shall receive a guaranteed payment of [Amount] per [Time Period] regardless of Partnership profits.

- Option D: Partners may take draws against anticipated profits, not exceeding [Amount or Percentage] of their anticipated share, subject to approval by [Specify Decision-Making Process].

Duties and Rights of Partners

- Option A: All Partners shall have equal rights in the management and conduct of the Partnership business.

- Option B: [Partner Name(s)] shall be designated as the managing partner(s) and shall have primary responsibility for the day-to-day operations of the Partnership.

Meetings of the Partners shall be held [Frequency, e.g., monthly, quarterly].

A quorum for any meeting of the Partners shall consist of [Number or Percentage] of the Partners.

- Option A: Decisions shall be made by a majority vote of the Partners.

- Option B: Certain major decisions, including but not limited to [List of Major Decisions, e.g., incurring debt over a certain amount, admitting new partners], shall require the unanimous consent of the Partners.

No Partner shall have the authority to [List of Restrictions on Authority, e.g., incur debt exceeding \$[Amount] without prior written consent of the other Partners].

Admission of New Partners

- No new Partner shall be admitted to the Partnership without the [Specify Approval Requirement, e.g., unanimous written consent of all existing Partners].

- Any new Partner shall be required to make a capital contribution of [Specify Amount or Method of Determining Amount].

- The admission of a new partner will result in a recalculation of the ownership percentages of all partners, as determined by [Specify Method of Recalculation].

Withdrawal, Expulsion, and Transfer of Interests

- Option A: A Partner may withdraw from the Partnership at any time by giving [Number] days' written notice to the other Partners.

- Option B: A Partner may not withdraw from the Partnership without the consent of all other Partners.

- Option C: A Partner may be expelled from the Partnership for [Reasons for Expulsion, e.g., gross misconduct, breach of this Agreement] by a [Specify Approval Requirement, e.g., unanimous vote of the other Partners].

- Option A: A Partner may transfer their interest in the Partnership to a third party with the [Specify Approval Requirement, e.g., unanimous written consent of all other Partners].

- Option B: Before transferring their interest, a Partner must offer the other Partners the right of first refusal to purchase their interest at a price equal to [Specify Method of Determining Price, e.g., fair market value as determined by an independent appraiser].

Upon withdrawal, expulsion, or transfer of interest, the remaining partners will buy out the departing partner’s interest based on [Specify Method for Determining Buy-Out Value].

Dissolution

- The Partnership shall be dissolved upon the occurrence of any of the following events:

- Option A: The unanimous written consent of all Partners.

- Option B: The death, withdrawal, or incapacity of a Partner, unless the remaining Partners elect to continue the Partnership as provided below.

- Option C: Judicial dissolution pursuant to Kansas law.

- Option D: [Other Event Causing Dissolution]

In the event of dissolution, the assets of the Partnership shall be liquidated and distributed in the following order: (1) to creditors, including Partner creditors; (2) to repayment of Partner loans; (3) to repayment of Partner capital contributions; (4) any remainder to Partners in proportion to their respective percentage interests.

- Option A: Upon the death, withdrawal, or incapacity of a Partner, the remaining Partners may elect to continue the Partnership by purchasing the departing Partner's interest as provided above.

- Option B: Upon the death, withdrawal, or incapacity of a Partner, the Partnership shall be dissolved.

Financial Provisions

- [Partner Name] is hereby designated as the Tax Partner/Partnership Representative for purposes of federal and state tax law.

- The Partnership shall use the [Accounting Method, e.g., cash, accrual] method of accounting.

- The fiscal year of the Partnership shall end on [Date].

- All Partnership books and records shall be kept at [Location] and shall be open to inspection by any Partner at any reasonable time.

- The Partnership shall maintain a bank account at [Bank Name]. All withdrawals from said account shall require the signature of [Authorized Signatories].

- The Partnership shall distribute Schedule K-1s to each partner on or before [Date] each year.

Partner Compensation

- Option A: Partners shall be reimbursed for all reasonable expenses incurred on behalf of the Partnership.

- Option B: [Partner Name] shall receive a salary of [Amount] per [Time Period] for their services to the Partnership.

- Option C: The Partnership shall provide health insurance or retirement benefits to the Partners as determined by [Specify Decision-Making Process].

Confidentiality and Intellectual Property

- Each Partner shall maintain the confidentiality of all Partnership business secrets and sensitive information.

- Option A: All intellectual property created by the Partners in connection with the Partnership business shall be jointly owned by the Partners in proportion to their respective percentage interests.

- Option B: All intellectual property created by the Partners in connection with the Partnership business shall be owned solely by the Partnership.

Conflict of Interest and Non-Competition

- Each Partner shall disclose any potential conflicts of interest to the other Partners.

- Option A: No Partner shall engage in any business activity that is directly competitive with the Partnership's business.

- Option B: Partners are permitted to engage in other business activities, provided they do not materially harm the partnership.

- Option C: Upon withdrawal from the partnership, a partner shall not compete with the partnership within [Geographic Area] for a period of [Number] years. This provision shall be enforceable to the extent permitted by Kansas law.

Partners shall not solicit clients or employees of the partnership for a period of [Number] years after withdrawing from the partnership.

Insurance

- The Partnership shall maintain general liability insurance in the amount of [Amount].

- The Partnership shall maintain key person life insurance on [Partner Name] in the amount of [Amount].

- The Partnership shall maintain worker’s compensation insurance as required by Kansas law.

Indemnification and Liability

- To the extent permitted by Kansas law, the Partnership shall indemnify and hold harmless each Partner from and against any and all losses, claims, damages, liabilities, and expenses arising out of the Partner's activities on behalf of the Partnership.

- Option A: No Partner shall be liable to the other Partners for any act or omission taken in good faith on behalf of the Partnership.

- Option B: Partners may be liable for acts of gross negligence, fraud, or willful misconduct.

Partners hereby waive any cause of action against each other except for acts of fraud or intentional misconduct.

Dispute Resolution

- This Agreement shall be governed by and construed in accordance with the laws of the State of Kansas.

- Option A: Any dispute arising out of or relating to this Agreement shall be submitted to mediation in [City, Kansas] before resorting to litigation.

- Option B: Any dispute arising out of or relating to this Agreement shall be settled by binding arbitration in [City, Kansas] in accordance with the rules of the American Arbitration Association.

If mediation or arbitration is unsuccessful, any legal action shall be brought in the state or federal courts located in [County, Kansas].

Kansas Specific Provisions

- Pursuant to the Revised Uniform Partnership Act as adopted in Kansas, default rules regarding voting, dissolution, and fiduciary duties apply unless otherwise modified in this agreement.

- Option A: The partners do not wish to modify the default rules established by the Revised Uniform Partnership Act.

- Option B: The partners wish to modify the following default rules established by the Revised Uniform Partnership Act: [Specify Modifications].

Partnership property shall be held in the name of the partnership.

Spouses of partners have no community property rights in the partnership.

The partnership will comply with all applicable Kansas state tax requirements.

If the partnership employs personnel, it will adhere to prevailing wage and employment requirements as mandated by Kansas and federal law.

The partnership will not discriminate against any employee or applicant based on age, race, gender, or other protected characteristic.

- Option A: The partnership will also not discriminate based on sexual orientation.

- Option B: The partnership will also not discriminate based on gender identity.

Amendment

This Agreement may be amended only by a written instrument signed by all of the Partners.

Severability

If any provision of this Agreement is held to be invalid or unenforceable, the remaining provisions shall remain in full force and effect.

Waiver

No waiver of any provision of this Agreement shall be effective unless in writing and signed by the party against whom the waiver is sought to be enforced.

Integration

This Agreement constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior or contemporaneous communications and proposals, whether oral or written.

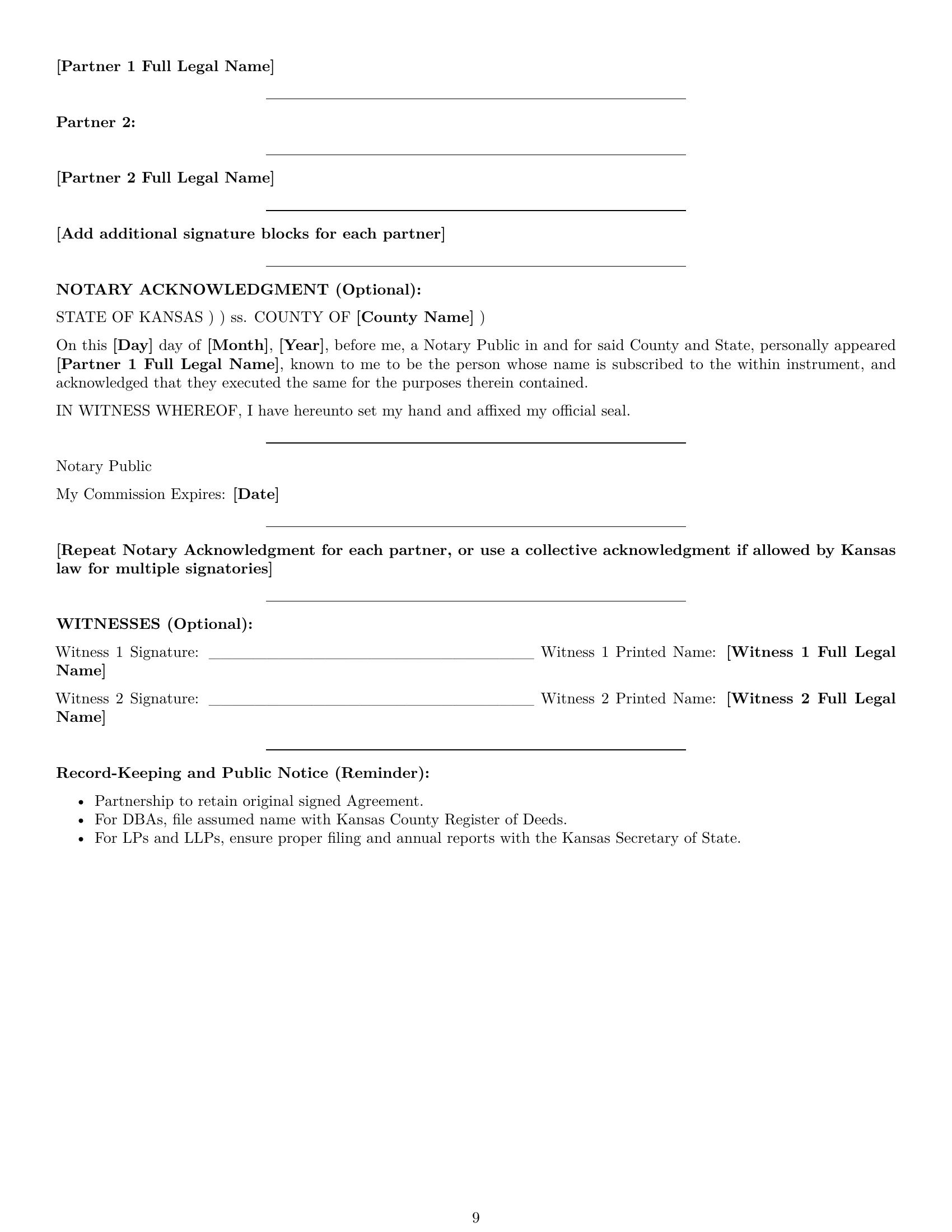

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

____________________________

[Partner 1 Name]

____________________________

[Partner 2 Name]

____________________________

[Partner 3 Name]

(Add additional signature blocks as needed)

[Notary Acknowledgment or Witness Signatures, as desired]