California warehouse lease agreement template

View and compare the Free version and the Pro version.

Help Center

Need to learn how to convert downloaded contract DOCX files to PDF or add electronic signatures? Please visit our Help Center for detailed guidance.

How California warehouse lease agreement Differ from Other States

-

California mandates strict compliance with hazard disclosure laws, requiring lessors to inform tenants of known environmental hazards.

-

Unlike many states, California lease agreements must often address seismic retrofit requirements and energy efficiency disclosures.

-

California enforces unique tenant protections, such as extended notice periods and limits on security deposit amounts for warehouse leases.

Frequently Asked Questions (FAQ)

-

Q: Do California warehouse lease agreements require environmental disclosures?

A: Yes, California law requires landlords to provide disclosure of known hazardous substances and other environmental hazards.

-

Q: Are there specific seismic safety requirements included in California warehouse leases?

A: Yes, leases must often disclose whether the property meets seismic safety standards or if seismic retrofitting is needed.

-

Q: Is there a security deposit limit for warehouse leases in California?

A: California law restricts security deposit amounts, generally not exceeding two months’ rent for commercial properties.

HTML Code Preview

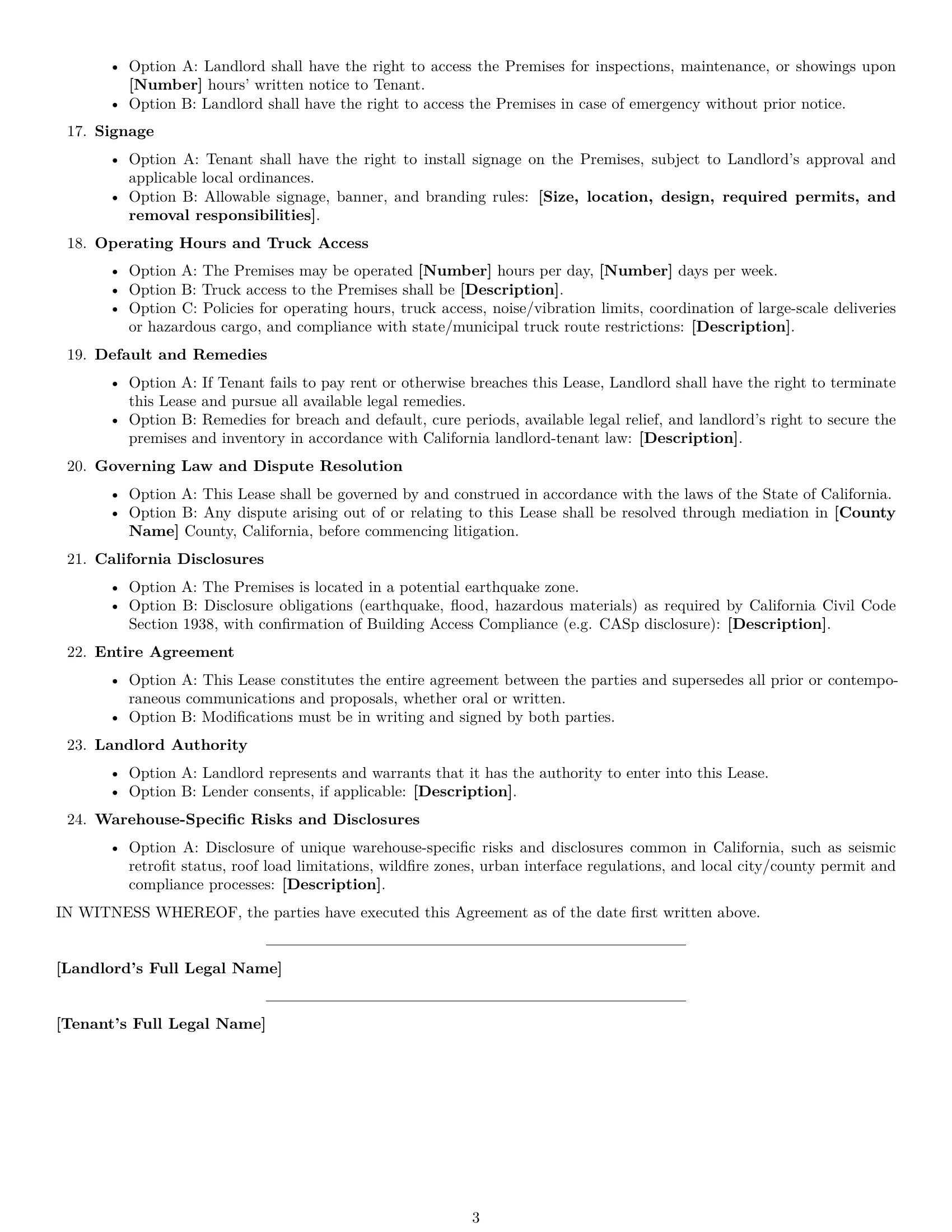

California Warehouse Lease Agreement

This Warehouse Lease Agreement (the “Agreement”) is made and entered into as of [Date], by and between [Landlord's Full Legal Name], residing at [Landlord's Address] (“Landlord”), and [Tenant's Full Legal Name], a [State] [Entity Type, e.g., Corporation], with its principal place of business at [Tenant's Address] (“Tenant”).

1. Premises

Option A: Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, that certain warehouse space (the “Premises”) located at [Street Address], City of [City], County of [County], State of California, with Assessor’s Parcel Number (APN) [APN].

Option B: The Premises is further described as follows:

- Square footage: [Square Footage]

- Building dimensions: [Dimensions]

- Site Plan: Attached as Exhibit A.

- Loading Dock Specifications: [Description]

- Clear Height: [Height]

- Floor Load Capacity: [Capacity]

- Access Points: [Description]

- Doors: [Number and Configuration]

- Parking: [Truck and Employee Parking Details]

- Demised Office/Storage Space: [Description and Square Footage]

Boundaries for exclusive use areas versus common areas, such as driveways, maneuvering yards, storage yards, and shared facilities: [Detailed Description]. Shared facilities may include: Forklifts, Security Gates, Yard Lighting, Truck Scales (if applicable).

2. Use

Option A: The Premises shall be used solely for [Permitted Use, e.g., general storage, logistics, light industrial].

Option B: Prohibited Uses: Tenant shall not use the Premises for any unlawful purpose, including, but not limited to, any use that violates local zoning ordinances or California environmental regulations, or for any of the following activities: [List of Prohibited Uses]. Tenant shall comply with all applicable California and local zoning ordinances, building codes, and fire safety regulations.

Option C: Compliance with California and local regulations is required, including, but not limited to: California Building Code, California Fire Code, Proposition 65, Hazardous Substances Account Act, and California Health & Safety Code Chapter 6.95 for hazardous materials business plans.

3. Term

Option A: The term of this Lease shall commence on [Start Date] and shall expire on [Expiration Date].

Option B: Renewal Option: Tenant shall have the option to renew this Lease for an additional term of [Number] years, provided that Tenant gives Landlord written notice of its intent to renew at least [Number] days prior to the expiration of the initial term.

Option C: Early Termination: Early termination of this lease is subjected to a penalty fee of [Dollar Amount]. In the event Tenant files bankruptcy or fails to comply with applicable regulations, the Landlord has the option to terminate the lease agreement early.

4. Rent

Option A: The monthly base rent shall be [Dollar Amount], payable in advance on the first day of each month.

Option B: Annual Rent Escalation: The monthly base rent shall increase annually by [Percentage] percent, commencing on [Date].

Option C: Late Payment Penalty: If rent is not received within [Number] days of the due date, a late fee of [Dollar Amount or Percentage] will be assessed.

Option D: Security Deposit: Tenant shall deposit with Landlord a security deposit in the amount of [Dollar Amount].

5. Taxes and Utilities

Option A: Landlord shall be responsible for the payment of property taxes.

Option B: Tenant shall be responsible for the payment of all utilities, including water, gas, electricity, and trash/recycling.

Option C: Common Area Maintenance (CAM): Tenant shall pay its proportionate share of CAM expenses, calculated as [Calculation Method].

Option D: Tenant shall be responsible for gross receipts, sales, or property taxes.

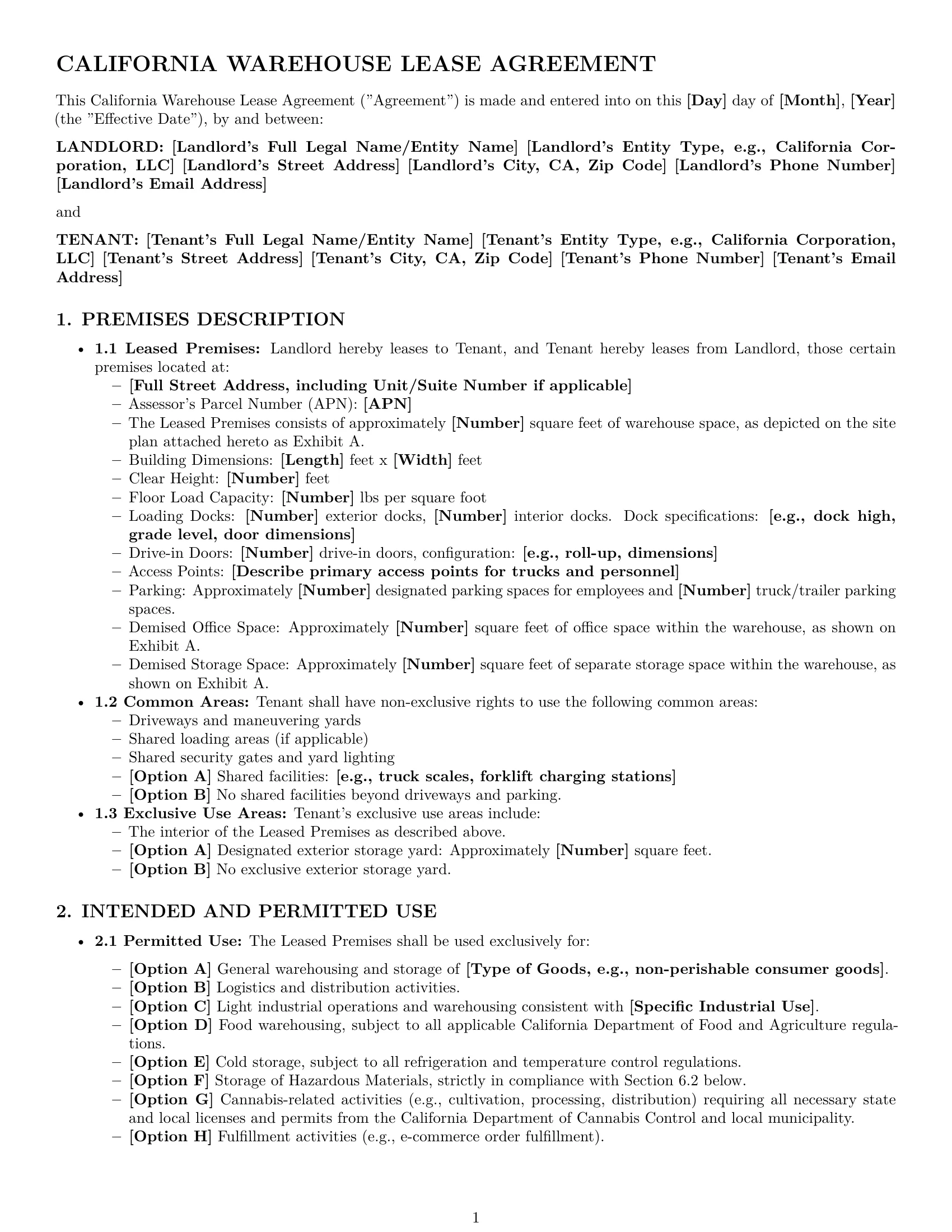

6. Alterations and Improvements

Option A: Tenant shall not make any alterations or improvements to the Premises without Landlord's prior written consent.

Option B: All alterations and improvements shall be at Tenant's sole cost and expense and shall become the property of Landlord upon termination of this Lease.

Option C: Tenant restoration obligations at lease expiry and procedures for removal of racking, machinery, trash, and repair of slab or dock damage: [Description].

7. Maintenance and Repair

Option A: Landlord shall be responsible for maintaining the roof, structure, and slab of the Premises.

Option B: Tenant shall be responsible for maintaining the loading docks, doors, HVAC units, and lighting within the Premises.

Option C: Tenant shall promptly report any damage, leaks, or structural concerns to Landlord.

Option D: Tenant is responsible for pest prevention and security infrastructure maintenance.

8. Insurance

Option A: Tenant shall maintain commercial general liability insurance in the amount of [Dollar Amount], naming Landlord as an additional insured.

Option B: Tenant shall maintain property insurance covering all of Tenant's personal property and equipment on the Premises.

Option C: Tenant shall maintain worker's compensation insurance as required by California law.

9. Fire and Safety

Option A: Tenant shall maintain and inspect all fire alarm and sprinkler systems.

Option B: Tenant shall develop and maintain an evacuation plan.

Option C: The parties will coordinate annually with the local fire department.

10. Environmental Compliance

Option A: Tenant shall comply with all applicable environmental laws and regulations.

Option B: Tenant shall be responsible for remediating any contamination caused by Tenant.

Option C: Landlord shall have the right to conduct environmental audits of the Premises.

11. Move-In and Move-Out

Option A: Tenant shall return the Premises in the same condition as received, ordinary wear and tear excepted.

Option B: Tenant shall remove all of its personal property and equipment from the Premises upon termination of this Lease.

Option C: The Security deposit will be returned within [Number] days of lease termination.

12. Subleasing and Assignment

Option A: Tenant shall not sublease the Premises or assign this Lease without Landlord's prior written consent.

Option B: Landlord's consent to any sublease or assignment shall not be unreasonably withheld.

13. ADA Compliance

Option A: Tenant shall comply with the Americans with Disabilities Act (ADA) and the California Disabled Persons Act.

Option B: Tenant shall indemnify Landlord from any claims arising out of Tenant's failure to comply with the ADA or the California Disabled Persons Act.

14. Landlord Warranties

Option A: Landlord warrants that the Premises is suitable and legally permitted for warehouse use.

Option B: Landlord warrants that the Premises is free from known environmental contamination.

15. Tenant Warranties

Option A: Tenant warrants that it will conduct its business in a lawful manner.

Option B: Tenant warrants that it will obtain all necessary licenses and permits.

16. Landlord Access

Option A: Landlord shall have the right to access the Premises for inspections, maintenance, or showings upon [Number] hours' written notice to Tenant.

Option B: Landlord shall have the right to access the Premises in case of emergency without prior notice.

17. Signage

Option A: Tenant shall have the right to install signage on the Premises, subject to Landlord's approval and applicable local ordinances.

Option B: Allowable signage, banner, and branding rules: [Size, location, design, required permits, and removal responsibilities].

18. Operating Hours and Truck Access

Option A: The Premises may be operated [Number] hours per day, [Number] days per week.

Option B: Truck access to the Premises shall be [Description].

Option C: Policies for operating hours, truck access, noise/vibration limits, coordination of large-scale deliveries or hazardous cargo, and compliance with state/municipal truck route restrictions: [Description].

19. Default and Remedies

Option A: If Tenant fails to pay rent or otherwise breaches this Lease, Landlord shall have the right to terminate this Lease and pursue all available legal remedies.

Option B: Remedies for breach and default, cure periods, available legal relief, and landlord’s right to secure the premises and inventory in accordance with California landlord-tenant law: [Description].

20. Governing Law and Dispute Resolution

Option A: This Lease shall be governed by and construed in accordance with the laws of the State of California.

Option B: Any dispute arising out of or relating to this Lease shall be resolved through mediation in [County Name] County, California, before commencing litigation.

21. California Disclosures

Option A: The Premises is located in a potential earthquake zone.

Option B: Disclosure obligations (earthquake, flood, hazardous materials) as required by California Civil Code Section 1938, with confirmation of Building Access Compliance (e.g. CASp disclosure): [Description].

22. Entire Agreement

Option A: This Lease constitutes the entire agreement between the parties and supersedes all prior or contemporaneous communications and proposals, whether oral or written.

Option B: Modifications must be in writing and signed by both parties.

23. Landlord Authority

Option A: Landlord represents and warrants that it has the authority to enter into this Lease.

Option B: Lender consents, if applicable: [Description].

24. Warehouse-Specific Risks and Disclosures

Option A: Disclosure of unique warehouse-specific risks and disclosures common in California, such as seismic retrofit status, roof load limitations, wildfire zones, urban interface regulations, and local city/county permit and compliance processes: [Description].

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

____________________________

[Landlord's Full Legal Name]

____________________________

[Tenant's Full Legal Name]