California partnership agreement template

View and compare the Free version and the Pro version.

Help Center

Need to learn how to convert downloaded contract DOCX files to PDF or add electronic signatures? Please visit our Help Center for detailed guidance.

How California partnership agreement Differ from Other States

-

California recognizes both general and limited partnerships with specific rules under the California Corporations Code, which may differ from other states’ statutes and definitions.

-

California mandates the filing of a Statement of Partnership Authority for certain powers and requires public disclosure, which is not standard in all states.

-

Partnership dissolution procedures are more detailed in California, including requirements for public notice and winding up under state law.

Frequently Asked Questions (FAQ)

-

Q: Is a written partnership agreement required in California?

A: No, a written agreement is not mandatory, but having one helps avoid disputes and clarifies the partners’ obligations.

-

Q: What should a California partnership agreement include?

A: Typical elements include partners’ names, contributions, profit and loss division, management duties, dispute resolution, and exit procedures.

-

Q: Do I need to file my partnership agreement with the state of California?

A: No, but you must file a Statement of Partnership Authority for the partnership to gain certain legal powers and recognition.

HTML Code Preview

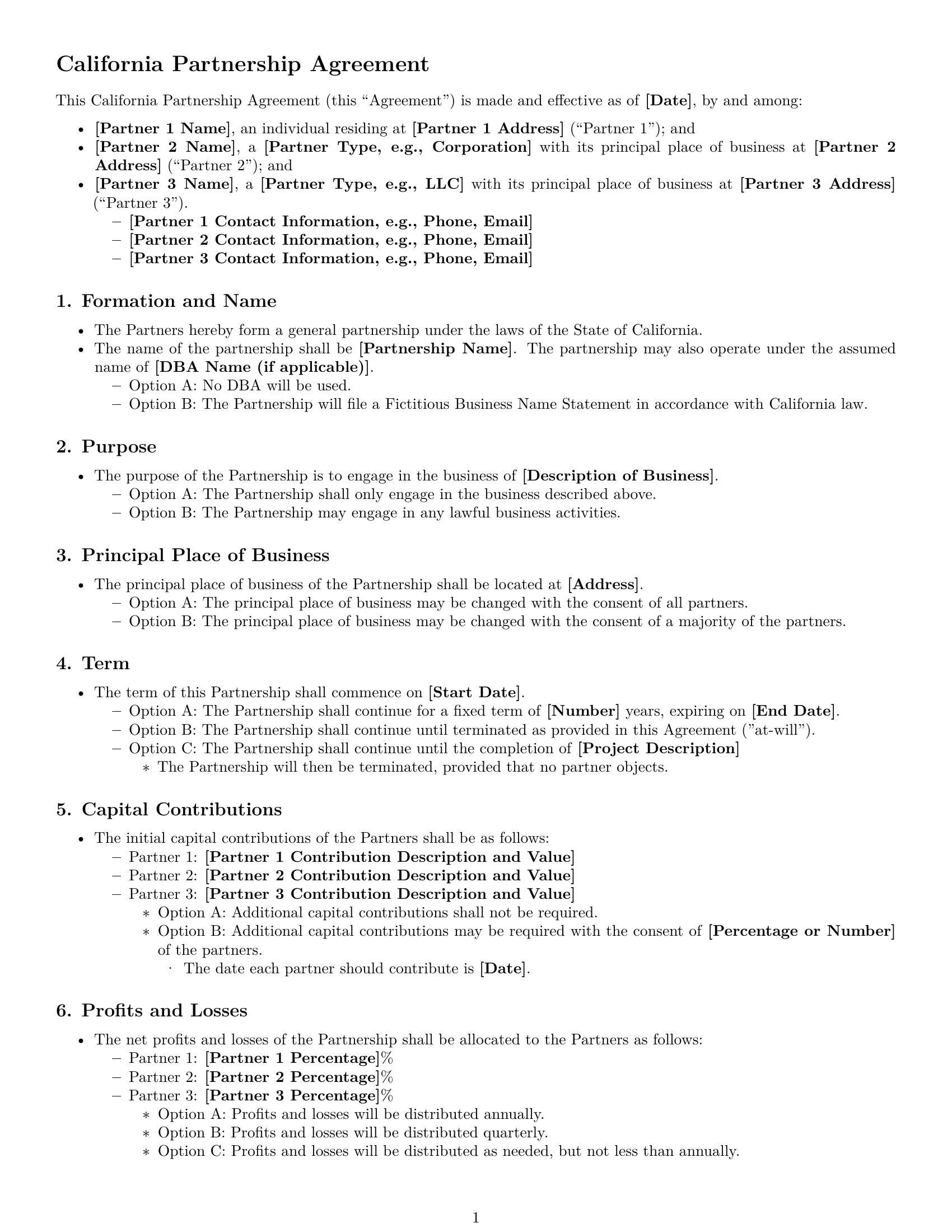

California Partnership Agreement

This California Partnership Agreement (this “Agreement”) is made and effective as of [Date], by and among:

- [Partner 1 Name], an individual residing at [Partner 1 Address] (“Partner 1”); and

- [Partner 2 Name], a [Partner Type, e.g., Corporation] with its principal place of business at [Partner 2 Address] (“Partner 2”); and

- [Partner 3 Name], a [Partner Type, e.g., LLC] with its principal place of business at [Partner 3 Address] (“Partner 3”).

- [Partner 1 Contact Information, e.g., Phone, Email]

- [Partner 2 Contact Information, e.g., Phone, Email]

- [Partner 3 Contact Information, e.g., Phone, Email]

1. Formation and Name

- The Partners hereby form a general partnership under the laws of the State of California.

- The name of the partnership shall be [Partnership Name]. The partnership may also operate under the assumed name of [DBA Name (if applicable)].

- Option A: No DBA will be used.

- Option B: The Partnership will file a Fictitious Business Name Statement in accordance with California law.

2. Purpose

- The purpose of the Partnership is to engage in the business of [Description of Business].

- Option A: The Partnership shall only engage in the business described above.

- Option B: The Partnership may engage in any lawful business activities.

3. Principal Place of Business

- The principal place of business of the Partnership shall be located at [Address].

- Option A: The principal place of business may be changed with the consent of all partners.

- Option B: The principal place of business may be changed with the consent of a majority of the partners.

4. Term

- The term of this Partnership shall commence on [Start Date].

- Option A: The Partnership shall continue for a fixed term of [Number] years, expiring on [End Date].

- Option B: The Partnership shall continue until terminated as provided in this Agreement ("at-will").

- Option C: The Partnership shall continue until the completion of [Project Description]

- The Partnership will then be terminated, provided that no partner objects.

5. Capital Contributions

- The initial capital contributions of the Partners shall be as follows:

- Partner 1: [Partner 1 Contribution Description and Value]

- Partner 2: [Partner 2 Contribution Description and Value]

- Partner 3: [Partner 3 Contribution Description and Value]

- Option A: Additional capital contributions shall not be required.

- Option B: Additional capital contributions may be required with the consent of [Percentage or Number] of the partners.

- The date each partner should contribute is [Date].

6. Profits and Losses

- The net profits and losses of the Partnership shall be allocated to the Partners as follows:

- Partner 1: [Partner 1 Percentage]%

- Partner 2: [Partner 2 Percentage]%

- Partner 3: [Partner 3 Percentage]%

- Option A: Profits and losses will be distributed annually.

- Option B: Profits and losses will be distributed quarterly.

- Option C: Profits and losses will be distributed as needed, but not less than annually.

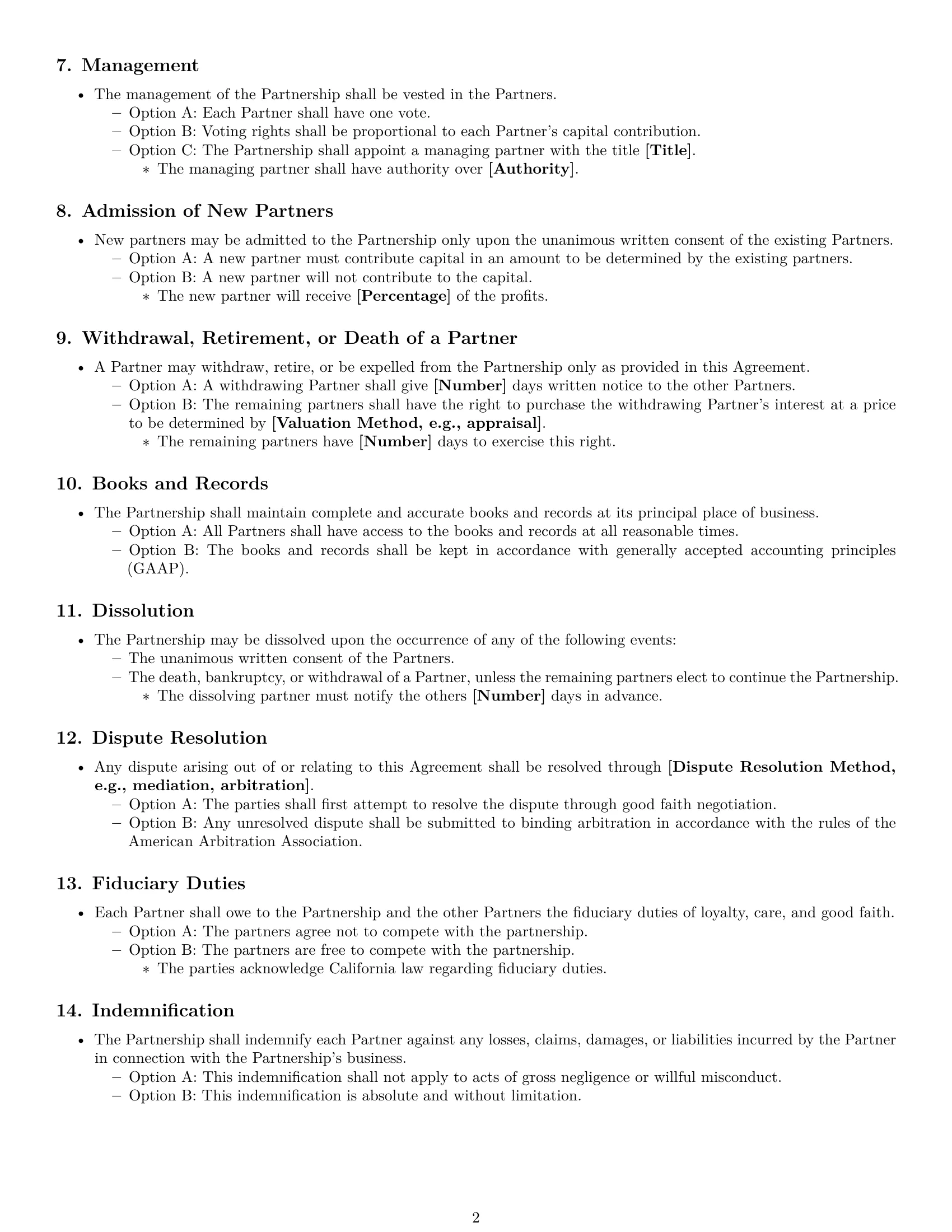

7. Management

- The management of the Partnership shall be vested in the Partners.

- Option A: Each Partner shall have one vote.

- Option B: Voting rights shall be proportional to each Partner's capital contribution.

- Option C: The Partnership shall appoint a managing partner with the title [Title].

- The managing partner shall have authority over [Authority].

8. Admission of New Partners

- New partners may be admitted to the Partnership only upon the unanimous written consent of the existing Partners.

- Option A: A new partner must contribute capital in an amount to be determined by the existing partners.

- Option B: A new partner will not contribute to the capital.

- The new partner will receive [Percentage] of the profits.

9. Withdrawal, Retirement, or Death of a Partner

- A Partner may withdraw, retire, or be expelled from the Partnership only as provided in this Agreement.

- Option A: A withdrawing Partner shall give [Number] days written notice to the other Partners.

- Option B: The remaining partners shall have the right to purchase the withdrawing Partner's interest at a price to be determined by [Valuation Method, e.g., appraisal].

- The remaining partners have [Number] days to exercise this right.

10. Books and Records

- The Partnership shall maintain complete and accurate books and records at its principal place of business.

- Option A: All Partners shall have access to the books and records at all reasonable times.

- Option B: The books and records shall be kept in accordance with generally accepted accounting principles (GAAP).

11. Dissolution

- The Partnership may be dissolved upon the occurrence of any of the following events:

- The unanimous written consent of the Partners.

- The death, bankruptcy, or withdrawal of a Partner, unless the remaining partners elect to continue the Partnership.

- The dissolving partner must notify the others [Number] days in advance.

12. Dispute Resolution

- Any dispute arising out of or relating to this Agreement shall be resolved through [Dispute Resolution Method, e.g., mediation, arbitration].

- Option A: The parties shall first attempt to resolve the dispute through good faith negotiation.

- Option B: Any unresolved dispute shall be submitted to binding arbitration in accordance with the rules of the American Arbitration Association.

13. Fiduciary Duties

- Each Partner shall owe to the Partnership and the other Partners the fiduciary duties of loyalty, care, and good faith.

- Option A: The partners agree not to compete with the partnership.

- Option B: The partners are free to compete with the partnership.

- The parties acknowledge California law regarding fiduciary duties.

14. Indemnification

- The Partnership shall indemnify each Partner against any losses, claims, damages, or liabilities incurred by the Partner in connection with the Partnership's business.

- Option A: This indemnification shall not apply to acts of gross negligence or willful misconduct.

- Option B: This indemnification is absolute and without limitation.

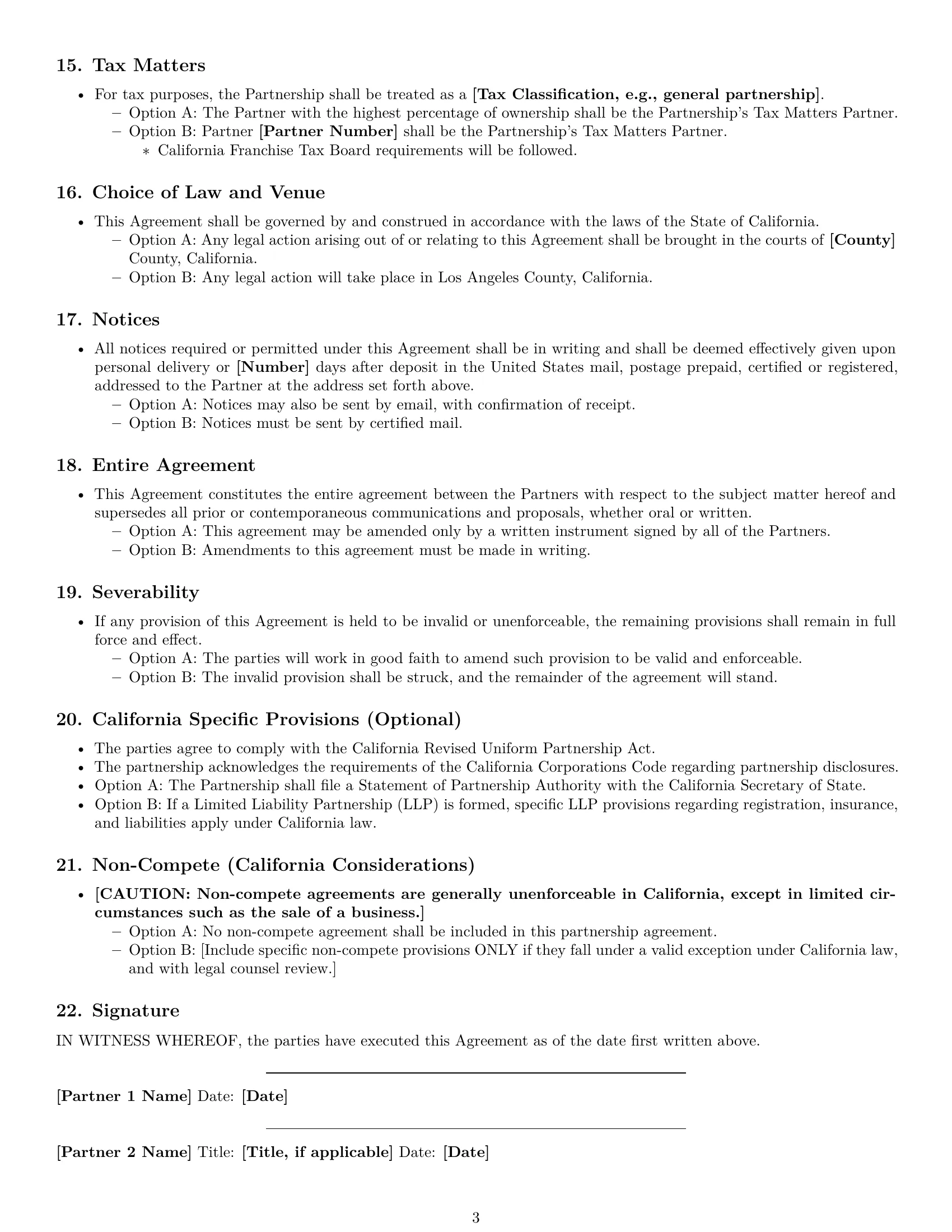

15. Tax Matters

- For tax purposes, the Partnership shall be treated as a [Tax Classification, e.g., general partnership].

- Option A: The Partner with the highest percentage of ownership shall be the Partnership's Tax Matters Partner.

- Option B: Partner [Partner Number] shall be the Partnership's Tax Matters Partner.

- California Franchise Tax Board requirements will be followed.

16. Choice of Law and Venue

- This Agreement shall be governed by and construed in accordance with the laws of the State of California.

- Option A: Any legal action arising out of or relating to this Agreement shall be brought in the courts of [County] County, California.

- Option B: Any legal action will take place in Los Angeles County, California.

17. Notices

- All notices required or permitted under this Agreement shall be in writing and shall be deemed effectively given upon personal delivery or [Number] days after deposit in the United States mail, postage prepaid, certified or registered, addressed to the Partner at the address set forth above.

- Option A: Notices may also be sent by email, with confirmation of receipt.

- Option B: Notices must be sent by certified mail.

18. Entire Agreement

- This Agreement constitutes the entire agreement between the Partners with respect to the subject matter hereof and supersedes all prior or contemporaneous communications and proposals, whether oral or written.

- Option A: This agreement may be amended only by a written instrument signed by all of the Partners.

- Option B: Amendments to this agreement must be made in writing.

19. Severability

- If any provision of this Agreement is held to be invalid or unenforceable, the remaining provisions shall remain in full force and effect.

- Option A: The parties will work in good faith to amend such provision to be valid and enforceable.

- Option B: The invalid provision shall be struck, and the remainder of the agreement will stand.

20. California Specific Provisions (Optional)

- The parties agree to comply with the California Revised Uniform Partnership Act.

- The partnership acknowledges the requirements of the California Corporations Code regarding partnership disclosures.

- Option A: The Partnership shall file a Statement of Partnership Authority with the California Secretary of State.

- Option B: If a Limited Liability Partnership (LLP) is formed, specific LLP provisions regarding registration, insurance, and liabilities apply under California law.

21. Non-Compete (California Considerations)

- [CAUTION: Non-compete agreements are generally unenforceable in California, except in limited circumstances such as the sale of a business.]

- Option A: No non-compete agreement shall be included in this partnership agreement.

- Option B: [Include specific non-compete provisions ONLY if they fall under a valid exception under California law, and with legal counsel review.]

22. Signature

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

____________________________

[Partner 1 Name]

Date: [Date]

____________________________

[Partner 2 Name]

Title: [Title, if applicable]

Date: [Date]

____________________________

[Partner 3 Name]

Title: [Title, if applicable]

Date: [Date]

- Option A: Notarization is required.

- Option B: Notarization is not required.